Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

January 23, 2017

AllInvestingNews

Stock Markets

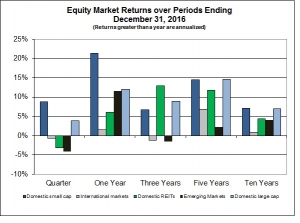

While markets were down early in the quarter, most, but not all, have bounced back since the Election with small company stocks and value stocks leading the way. Stocks tr aded in international markets and emerging markets have not fared as well in this period, reflecting a strengthening of the dollar. This means a globally diversified stock portfolio would not have done as well as what might be implied by the media hype.

aded in international markets and emerging markets have not fared as well in this period, reflecting a strengthening of the dollar. This means a globally diversified stock portfolio would not have done as well as what might be implied by the media hype.

While not everyone looks back at 2016 with delight, the past year was not bad for stocks – especially domestic stocks. These stocks, as well as emerging market stocks, were up over 12% (small cap stocks up 21%) for the year. Stocks traded in international developed markets lagged, earning just 1.5% for the year.

The accompanying chart that displays not only recent, but also longer-term results, is a picture of the effects of diversification. Look at how some markets are up and others are down, but they tend to even out over longer periods.

Bond Markets

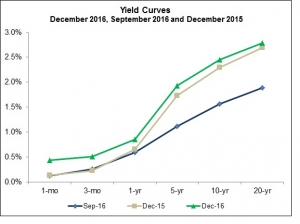

The accompanying chart of Yield Curves tells us a couple of things. First, look at how yields for maturities greater than five years jumped nearly 1% since September 30, 2016. Increasing yields will drive bond returns down – the longer the time to maturity, the bigger the drop. This means we have losses from bond investments this quarter, especially from bonds with longer periods to maturity. Increased yiel ds at the short end are consistent with the Fed’s recent vote to increase short-term rates; the increases over longer periods have more to do with expectations for economic growth and inflation.

ds at the short end are consistent with the Fed’s recent vote to increase short-term rates; the increases over longer periods have more to do with expectations for economic growth and inflation.

Second, these Yield Curves show a relatively minor year-over-year change. While in 2016 long-term bonds did earn over 4%, reflecting the drop in yields earlier in the year, returns from both intermediate-term and short-term bonds were about flat. Bond market allocations just haven’t contributed much in recent periods – stocks have carried the day. This will not always be the case.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.