Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 10, 2012

AllNews

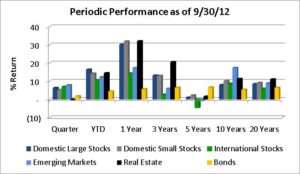

The equity markets finished a very strong quarter in September, erasing the losses of the second quarter, and more, pushing returns solidly into double-digit territory for the year.

If the S&P 500 could hold its 16% gain through the next quarter, it would be the third best annual result of the past decade, and above the historical average of 10%-12%.

Bonds also provided positive returns for the quarter. U.S. Treasury yields remained fairly constant for the period but interest rates paid by high-yield issuers (junk bonds) continued to fall, so increasi ng values boosted returns for bonds that are subject to credit risk.

ng values boosted returns for bonds that are subject to credit risk.

In the chart at the right you will also see that Real Estate (REITs) had a poor quarter, allowing other parts of the equity market to catch up on a year-to-date-basis.

Some Things Cannot Last Forever

Herbert Stein was a distinguished academic and chairman of the President’s Council of Economic Advisers in the 1970’s. He formulated “Herbert Stein’s Law,” which he expressed as “If something cannot go on forever, it will stop.”

One thing that cannot go on forever is high bond returns, resulting from falling interest rates. At some point, rates hit bottom, and if not there yet, we are getting close. Rates could fall more from current levels – we need only look to Japan for evidence of that possibility. However, the Federal Reserve is now taking extraordinary measures to avoid the Japanese spiral of deflation that seems to be a big part of their problems.

Treasury Inflation Protected Securities (TIPS) have also benefited from falling rates in recent years, particularly the decline in real interest rates (the rate received net of inflation). The total return for TIPS this year is 6% and the annual return for the past five years is 7.6%, far ahead of the S&P 500, which gained only 1.1% over the past five years.

Some may think these returns will continue. Vanguard reports that in the past three years, TIPS funds garnered about $42 billion in net cash flow, representing just under 50% of the net cash flow received by TIPS funds in the ten years through June 2012.

Yet anyone investing in TIPS based on recent returns is very likely to be disappointed. The current pricing on TIPS reflects a market expectation that returns will just offset inflation over the next decade – an expected nominal return of 2%-2.5%, and a real return of 0%.

TIPS are also risky. TIPS funds are sensitive to changes in real interest rates and short-term returns can be volatile. Since 1997 when TIPS were first issued, there has been at least one 12-month period where TIPS lost 7.5% and another where they gained almost 20%.

So, why own TIPS at all, if expected returns are poor, and risk is significant? Well, they are still the most effective way to protect against an unexpected rise in inflation. If inflation averages more than 2%-2.5% over the next ten years, TIPS will provide a greater return to help offset the effect of inflation, so they can still provide valuable diversification.

TIPS can still play a role in a diversified portfolio, but investors should keep their expectations realistic – they will not provide the kind of returns we have seen in the past five years. An increase in real interest rates will have a negative impact on TIPS returns. A more detailed discussion of this topic is available in a research report written by Vanguard in September 2012, at https://personal.vanguard.com/pdf/icrtips.pdf.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.