Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 24, 2016

AllInvestingNews

Stock Markets

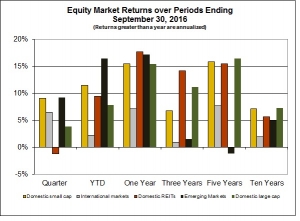

It was a pretty good quarter for stocks, with the riskier small-cap and emerging market stocks leading the way. REIT’s gave back some of their robust returns of prior periods. The year-to-date numbers for stocks are solid as well.

The riskier markets have done better this quarter, which is consistent with an increased appetite for risk. One concern is that much of the recent returns can be explained by the need to reach for risk to expect any sort of return. This can lead to a general mispricing of risk. Consequently, these excess returns are apt to be temporary.

The grey bar showing international markets in the above chart, except for the most recent quarter, hasn’t reached the heights of other market returns. It shows that this market has not kept pace with others over these periods. However, be careful as it says nothing about future returns from international markets.

The accompanying yield curves chart shows the yield to maturity of Treasury securities of various maturities. Note the little change over the September quarter, which is consistent with a more or less flat bond market. Yields for longer maturities have fallen since the beginning of the year, which reflects the relative attractiveness of U.S. Treasury securities in a world of negative interest rates.

Credit spreads (the difference between yields on corporate bonds versus comparable Treasury securities) have declined over the past quarter resulting in positive returns from investment grade corporate and especially high yield bonds. These declines are consistent with our theme of an increased appetite for risk.

The Value of Capital

I am usually skeptical of suggestions that we are entering a “new normal.” Yet, a case might be made that this time it’s different. The axiom that capital has value can be questioned – Central Banks can’t seem to give it away! Interest rates are the “price” of capital – it’s what’s paid to use capital. Interest rates near zero and, in some places, negative provides an indication of the value of capital today.

Central Banks worldwide, including the Fed, are not shy at providing capital at little or no cost. Banks are holding massive amounts of reserves; there is little appetite for rebuilding infrastructure and many corporations are finding the best use of capital is to buy back stock. Furthermore, in developed economies, human capital – not physical capital – is more of a driver of economic growth today. Apple, Microsoft, Facebook, Google and Amazon are relatively new names among today’s largest corporations, each of which is engaged in managing human capital primarily. This shift away from physical capital helps to explain the decline in demand and is consistent with a lower price of capital into the future. Perhaps a new normal.

This apparent reduced value for capital has implications for investors. First, is this really a new normal or is it temporary? Second, what is the impact on the price of risk going forward? Third, can we earn the returns of the past by judiciously managing risk, or will we have to accept reduced expected returns going forward? Fourth, are markets signaling deflation ahead?

As I said, I am generally skeptical of paradigm shifts and suggestions of a new normal. We have to deal with a lot of random behavior, and capital markets can be out of whack for extended periods. The current distortion could simply be the result of Central Banks acting alone without changes in fiscal policy to produce economic growth. Consequently, we must be careful about shifting our ideas about how the world works in response to what could turn out to be temporary aberrations.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.