Kick-Start Your Child’s Retirement Savings by Rolling Over Unused NYS 529 Plan Assets

With college costs increasing at a rate greater than inflation, investing within a 529 plan offers participants the opportunity to keep up with rising education expenses with some immediate tax savings upon funding. Since there are many unknown factors as to how much your child’s future education expenses will cost, it can be difficult to […]

Making the Case for International Exposure

“Why would I invest in anything other than the S&P 500 if it continues to do so well?” This is a question that is commonly asked by many of our clients over the past few years. To truly optimize your portfolio and ensure you’re not missing out on potential opportunities, it’s crucial to understand the […]

Tax Time – What to do with your refund?

Receiving a tax refund can be a great way to boost your savings, pay down debt, or invest in your future. But once you have that money in your pocket, where should you put it? Here are some of the best places to save a tax refund. Emergency fund An emergency fund is a crucial […]

Bank Run News

It’s hard, and often counterproductive to comment about breaking news while it’s still moving through the proverbial grinder … which is why we usually don’t do so. However, we feel it’s worth commenting on the current, growing number of regional bank runs. Before taking a look at the details, we’ll lead with two larger assurances: […]

Staying the Course and Holding Fast to Your Investment Strategy

From social media feeds to financial news outlets, we’re constantly bombarded with a stream of updates, opinions, and analysis. Access to so much information can be empowering, but can also be overwhelming. How do we know which sources to trust and where should we focus our attention? With inflation making daily headlines, stock market volatility, […]

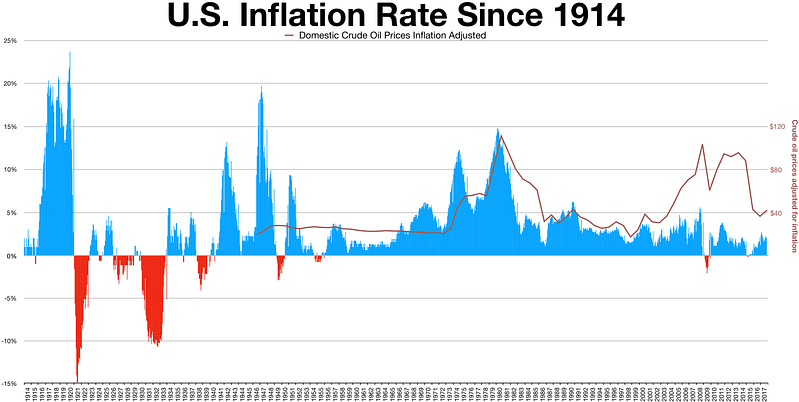

Inflation Commentary (August, 2022)

The Consumer Price Index (CPI) climbed to a historically high 9% over the past twelve months prompting concerns for ongoing inflation. There is much discussion in the popular press as to the causes and to the extent it is “transitory” or is becoming embedded in economic activity. While the emergence of inflation contributes to market […]

How Accurate Are Market Predictions?

If you ask 100 different financial “experts” about future stock market performance, you’ll get 100 different opinions. Most will be wrong, but some, by sheer luck, will be correct (luck is often confused for skill). Investors often rely on expert opinions on what to do with their investments, especially in volatile markets like we are […]

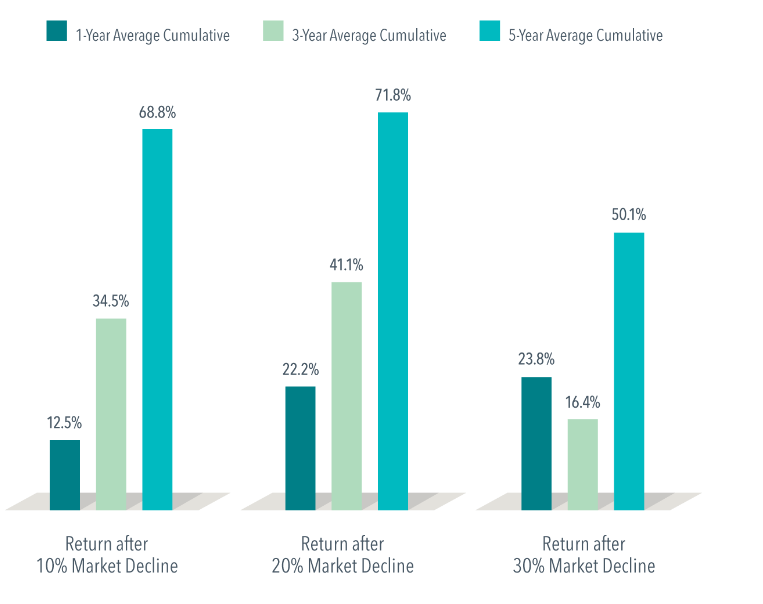

Bear Markets – What do they mean for investors in the long-term?

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]

Six Ways a Recession Resembles a Bad Mood

There’s been a lot of talk about recessions lately: Whether one is near, far, or perhaps already here. Whether we can or should try to avoid it. What it even means to be in a recession, and how it’s related to current market turmoil. To put market and recessionary concerns in perspective, it might help […]

Ignore the Headlines

Recent headlines have been dramatic as “Inflation Soars to Highest level in 40 Years!” and “Stocks Plunge to 2022 Lows!” It sounds like the authors are all shouting, and we should really panic. It feels like we should “do something” but let’s take a step back from the headlines, and put today’s market in perspective […]