Capital Market Activity – 05/31/2022

Stock Markets Although rebounding lately, all markets are down year to date. Since December stock markets are off more than 10%. Tech stocks are especially hard hit – an equally weighted portfolio of the largest domestic tech stocks (Apple, Microsoft, Amazon, Google, and Facebook) is off 25%. The premium to value markets, domestic and international, […]

Volatility – Like it or Not – is a Feature of Markets

Stock and bond markets alike are sorting their way through a potent brew of uncertainties these days. War, inflation, supply constraints, rising interest rates, growth concerns, and even crypto-currency dislocations are combining to drive markets lower by the day. It’s certainly no fun to sit through tumultuous markets, but turmoil like we’ve seen recently is […]

How the Conflict in the Ukraine affects Investors

The war that began this week between Russia and the Ukraine is a human tragedy and a stark reminder that dollars and cents are secondary to health and safety. Some of us who have friends and family in the areas affected by war are focused on the wellbeing of their loved ones. But for most […]

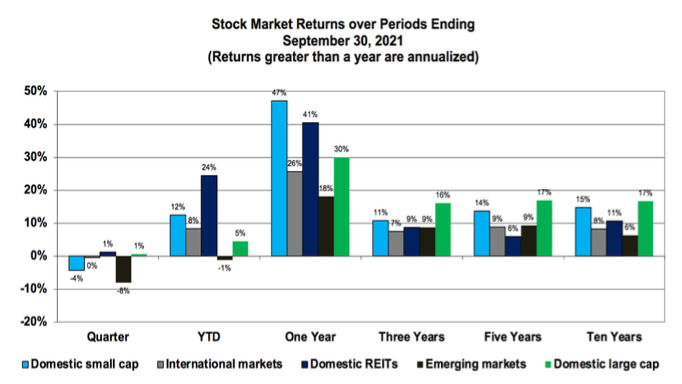

Market Commentary: Q3 2021

Stock market returns were mixed in the third quarter. Microsoft, Google and Apple led returns in the domestic large-cap stock market; stocks traded in international developed markets and REITs were also positive. The riskier domestic small-cap and emerging market stocks posted negative results, which dragged a portfolio diversified among all these markets down over 2% […]

State of the Labor Market

Covid-19 didn’t just bring volatility to the stock market, it also brought volatility to the labor market. The number of unemployed quadrupled from 5.7 million (3.5%) in February 2020 to 23.1 million (14.8%) in April 2020. Not surprisingly, the number of job openings decreased from 7.1 million to 4.6 million at that same time. Fortunately, […]

2020 active vs. passive

Each year the financial services company, Morningstar, issues a report of how actively managed funds performed relative to passive funds. Historically, actively managed funds have not performed as well as funds designed to simply replicate a market or published index. However, one argument active fund managers make is that they are “nimbler” during times of […]

How big are the largest American companies?

Somewhere between colossal and titanic. Apple, the largest publicly traded company in the world, has a market capitalization of $2.4 trillion. If it were its own country it would be slightly less valuable than all the publicly-traded stocks in Germany and slightly more valuable than those in South Korea. Microsoft is worth $2.2 trillion, a […]

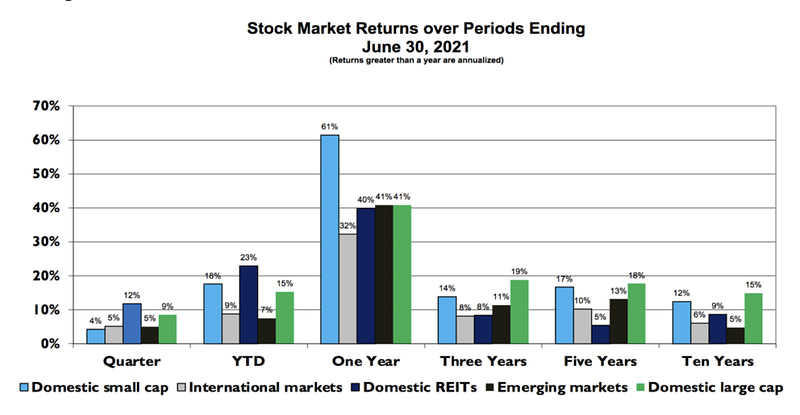

Market commentary: Q2 2021

Stock Markets: Stocks provided positive results over the most recent twelve-month period. While all markets have done well, especially stocks in domestic markets, the markets that lead and lag vary across the various periods. While not shown in this chart, a globally diversified stock portfolio earned over 12% over the three-year period ending June 30th, […]

The january effect was strong this year

In Syracuse, we see lake effect snow every January. But there’s another sizable “effect” in January if you know where to look. This one’s in the stock market. The “January Effect” is the outperformance of small-cap stocks versus large-cap stocks in the first month of the year. Going back to 1926, small companies have rallied […]

Great results, but greater expectations

Last week we saw some of the largest tech companies in the world report their earnings from the first quarter of 2021 and the numbers were impressive. Headlines on CNBC read: “Apple reports blowout quarter, booking more than $100 billion in revenue for the first time” “Tesla posts record net income of $438 million, revenue […]