Bear Markets – What do they mean for investors in the long-term?

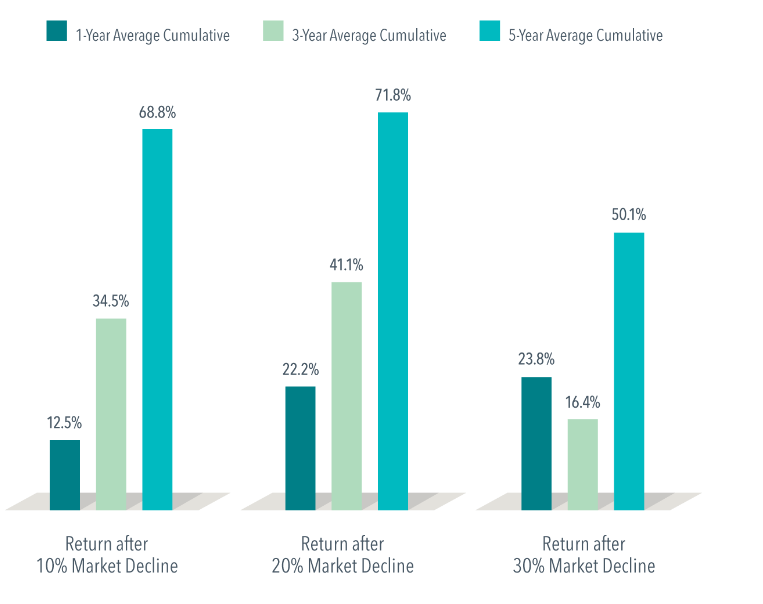

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]

What happens when you fail at market timing

Trying to time the market is nearly impossible; there is no way to predict when the market is going to perform well and above what we expect it to. However, by buying and holding a low-cost, globally diversified portfolio, we know that we will not miss out on the returns of the top performing days […]

Rockbridge’s guide to a “Bear Market”

Depending on the news you read, you may have come across headlines talking about bear markets and stock market corrections. The following is a guide to what they mean and how to put them in the context of history. The conventional definition of a bear market is a price drop in a stock market index […]

When investing, don’t think about the patriots

This past weekend, the New England Patriots did it again. Down 10 in the 4th, star quarterback Tom Brady orchestrated two scoring drives to pull off another comeback victory. In two weekends, the Pats will try to win their 3rd Super Bowl in 4 years – headlining a host of impressive statistics dating back to […]

Dow 22,000 – why we’re here and what it means

On August 2, 2017, the Dow Jones Industrial Average set a record, closing above 22,000 for the first time. People will debate the cause of the rally and how long it will last, but there is only one answer that matters to the prudent investor – time. Markets go up over time. Over the last […]

Another Surprise – Yet Again!

The recent vote in Britain to exit the European Union is yet another reminder of how markets often react negatively to surprises. We cannot help but ask ourselves, “Is it different this time? Maybe this is the event that upends markets as we know them, and I would be stupid not to react!” As it […]

Market Commentary January 2016

Stock Markets In 2015, domestic large cap stocks (S&P 500) and REITs were up while other markets were down – emerging markets were off big! The positive results in the S&P 500 were driven by just two stocks – Amazon and Google. Otherwise it would have looked like other market indices. These results, I think, […]

Investing and Action Movies

When we go to a good action flick, we enjoy the suspense and surprises, but no one wants that experience when investing. James Bond and Mission Impossible would not be box office hits without some interesting plot twists, and an occasional victory by the villain, and yet the end result is usually something we expect […]

Should You Manage Your Own Money?

Over the weekend, the Wall Street Journal writer Lindsay Gellman covered this important topic. She did an excellent job articulating the values of both hiring an advisor and managing your own personal finances. The sole point that I disagree with in the article is titled, “You won’t stick to a pro’s advice, anyway.” At […]

Gambling with Retirement? It’s Time You Take Control!

Over the years there has been a shift of burden in retirement savings from the employer to the employee. The era of company pension plans is fading, leaving Americans on their own to save for retirement; primarily through company-sponsored 401(k) plans. Frontline recently aired The Retirement Gamble, where it highlights some of the downfalls of […]