Build Back Better Act – Backdoor Roths

The year-end process can be stressful for many investors and 2021 is no different in terms of having proposed changes to the federal tax code. The proposed Build Back Better Act is currently structured to limit those who can use the “Backdoor Roth” strategy and/or make Roth Conversions in general. We don’t know if this […]

NYS tax update: PTET

If you itemize deductions on your federal tax return, you’ll recall that the 2017 tax law changes imposed a $10,000 cap on the amount of state income and property taxes (SALT) that you could deduct on your federal return. For many New York State taxpayers, this greatly reduced their federal itemized deductions and potentially forced them to […]

Tax planning in turbulent times part 1: the tools of the tax-planning trade

Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome. No wonder people get nervous when there’s lots of talk about higher taxes, but little certainty on what may come of it, and who it might affect. How do we plan […]

The certain uncertainty of tax legislation

Tax planning is all about identifying opportunities that arise because of changes to a person’s tax situation from one year to the next. Many people think they do not need to consider tax planning because the information on their tax return does not change much year-to-year. Since the end of 2017, at least six new […]

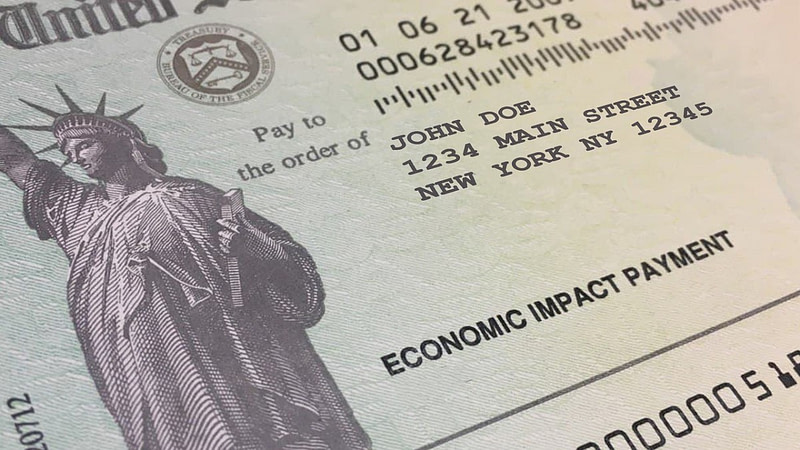

The American rescue plan act of 2021: understanding the 2021 recovery rebate stimulus payments

The American Rescue Plan Act of 2021 is now a done deal. Among the items of greatest interest to most Americans is a third round of stimulus checks – or IRS “recovery rebates” – of up to $1,400 for every “eligible individual.” That’s the quick take. But what’s the fine print? How Much Will You […]

Roth conversions

Roth IRA conversions can be an important potential tool for implementing a tax efficient retirement plan. At its core, a Roth conversion involves prepaying a deferred tax liability in exchange for tax free growth going forward. Conversions are ideal for people who are in lower tax bracket today than they are likely to be in […]

Changes to retirement rules – implications of the SECURE Act

The SECURE Act was passed last month as part of a larger government spending bill. The new law is wide ranging, affecting retirees, heirs, those with 401(k)s, and 529 holders. The following are the most impactful sections of the new law. New Rules on Inherited IRAs IRAs inherited from people who die after 1/1/2020 can […]

Qualified charitable distributions – a year-end tax tip

Are you 70 ½ or older? Do you still need to take part, or all, of your required minimum distribution (RMD) from your IRA? Are you planning on making any charitable donations before the end of the year? If the answers to these questions are yes, consider making the charitable donation(s) directly from your IRA. […]

Tax diversification of accounts in retirement

For nearly all investors, the importance of asset allocation and security diversification cannot be overlooked. Diversification can mean different things to investors, but the concept is pretty well understood – hold several different types of investments and you will be better served than those who are concentrated in one stock or in one narrow investment […]

Tax scams: what to look for and how to avoid them

As another tax season comes to a close, we wanted to draw attention to a number of scams and schemes to defraud unsuspecting taxpayers. We think it is important that our clients be aware of how these scams work, and what precautions you can take to protect yourself. How the Scams Work: One popular method […]