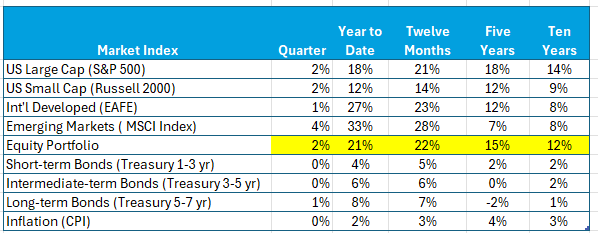

Stocks continue to provide extraordinary returns – bond returns above averages. Here’s the data:

Note especially:

- Recent stock returns

- Returns from a global stock portfolio

- Returns from International developed and emerging markets

- Recent bond returns

Stocks

Stocks continued their upward trajectory in October – our global portfolio earned above 2% (30% annualized). While there remains plenty of uncertainty – inflation, tariff implementation, political dysfunction to name a few – it has had little impact on the market so far.

Year-to-date has been especially rewarding: Our global portfolio earned 21%. This result reflects not only the impact of the “Magnificent Seven” (Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla), which are 36% of the S&P 500, and earned an average of 24%. Also, over this period International Developed and Emerging Markets earned 27% and 33%, respectively. Extraordinary!

The year-to-date results in our emerging markets allocation are explained primarily by three Asian markets – China, Korea, and Taiwan, which are just over 60% of the index.

Bonds, Bond, Yields, and Inflation

Since the first of the year bond yields fell more than 0.6% for most maturities – the 10-yr yield is just above 4%, down from 4.6% at the end of December. The Fed reduced its Federal Funds rate by 0.25% at its last meeting. Since bond returns are inversely related to yield changes (the longer the maturity the greater the impact), the decline in yields has been positive for bonds, especially for longer maturities.

While inflation remains a concern, it is not reflected in 5- and 10-year yields. The spread between nominal and inflation-adjusted yields, which is a reasonable proxy for expected inflation over the relevant periods, is 2.4% and 2.3% for 5- and 10-year maturities, respectively.

A Looming “Correction”?

Now, the worry is that we are on a path for a substantial correction. Fueling this concern is an overbuilding of data centers, each of which requires massive capital investment, the capacity to meet the demand for energy, the rate of adoption and impact of AI, and overvaluation by traditional measures.

Over the past year the magnificent seven earned 27%, which is clearly unsustainable. Using traditional valuation measures, a 50% correction in this portfolio is possible. Since these stocks are 37% of the capitalization of the S&P 500, a loss of this magnitude translates to a loss of 17% in the index, significantly damaging a portfolio.

If signs point to a correction, should we alter our allocations to this market? Probably not. There is little evidence that “market timing” pays off: First, it requires two decisions – when to get out and when to get back in. Rarely are both made at the “right” time. Second, market prices reflect traders’ best assessment of the future. While not necessarily “correct,” it is unbiased and theoretically includes all available relevant information. Third, it could be some time before the correction occurs – sellers would miss the upside. Finally, while significant, the S&P 500 is not the global market – other markets behave independently.

With the cacophony of noise around us, staying on the course requires discipline. Stocks are volatile. But most evidence suggests that enduring volatility is best in the long run.