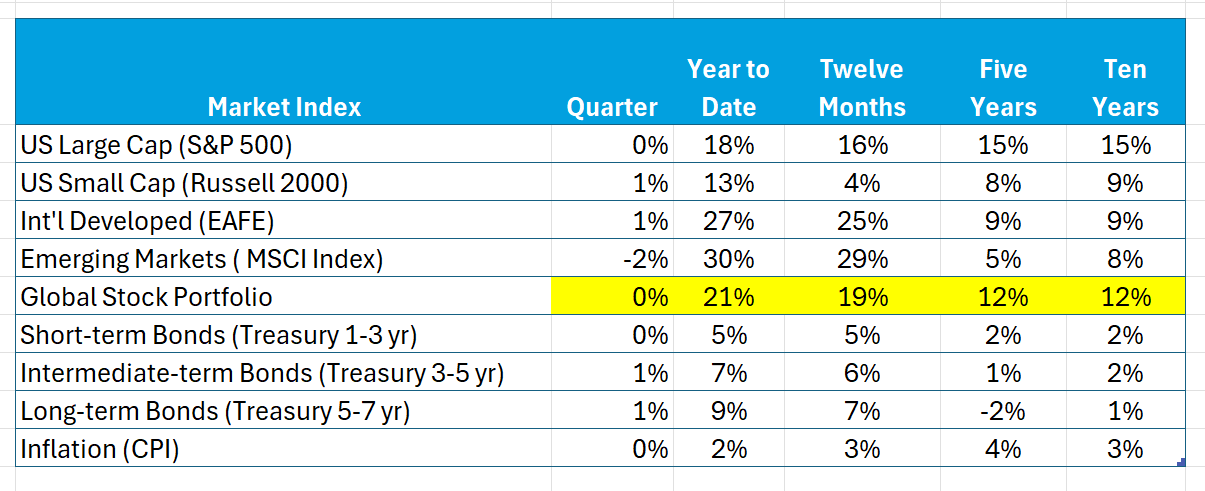

After bouncing back in the last week, stocks ended the month nearly flat. Here’s the data:

Note especially:

- Global stock portfolio returns (highlighted)

- Returns in international and emerging markets

- S&P 500 returns

- Year-to-date and one-year bond results

Stocks

After some ups and downs, stocks ended the month essentially flat. The S&P 500 results include the effect of a pause in the upward trajectory of the stocks expected to benefit from AI. In the Magnificent Seven, while Google was up 13%, the average of the other six companies ended the month off 5%. This volatility is consistent with the uncertainty in today’s economic landscape.

This year is shaping up to provide well-above average returns. Our equity portfolio is up nearly 21% year- to-date. Notice the variability among the various indices in the year-to-date and one-year periods, which is, of course, lessened by holding a portion of each in a diversified portfolio, which earned distinctly positive returns in all periods.

Except for the S&P 500 index, over the past ten years stock returns are consistent with long-term averages. The S&P 500 is well above these averages due to its heavy weighting of AI stocks.

Bonds, Bond, Yields, and Inflation

November saw no change in bond yields across all maturities – consequently, returns match the income from the coupon payments.

The spread between nominal and inflation-adjusted yields has not moved this month, indicating little change in expected inflation over the next five and ten years.

It’s the level of real (inflation-adjusted) yields that affect business investments and economic activity, not observed nominal yields. Currently, these yields are 1.3% and 1.9% for five and ten years, respectively. The rates are above what we have been used to and help to explain the focus on the Fed reducing interest rates further.

Anticipated Correction?

While snapping back in the last few days, the down markets earlier this month triggered concern for an anticipated correction. While there is plenty of uncertainty surrounding today’s markets, including future Fed actions on interest rates and any fallout from the sell-off in Crypto markets, since much of the recent run-up in values reflects AI, the concern is for waning exuberance for the future of this technology.

One of the more solid observations of long-run stock market behavior is that after many ups-and-downs, some of which can be significant, returns eventually match averages (expectations) – this is referred to as “regression to the mean.” For this observation to continue, periods of above average results must be followed by below average periods. Consequently, a “correction” of recent market results will not be surprising and is consistent with past behavior.

However, take care not to extrapolate one month far into the future; inflections will be best seen in hindsight. AI will be transformative. Its eventual implementation will no doubt be in “fits and starts.” As news about how AI unfolds is received randomly, it will be reflected in stock prices. Consequently, prices will be volatile. Recent stock market results are better explained by this volatility, not necessarily a shift in outlook.