Syracuse Orthopedic Specialists Resources

Rockbridge works with several physicians in the Syracuse area, and more specifically, physicians employed at Syracuse Orthopedic Specialists. Through these experiences, Rockbridge has become well-versed with the benefit programs offered by SOS. Discussed below are two areas in which we have been able to add value to our clients employed by SOS. 401(k) Investment Options […]

FamilyCare Medical Group – Agilon IPO & 401(k) Options

Rockbridge works with over 120 medical professionals, most of whom are in the Syracuse area. In addition to the expertise we’ve developed with providers, we have experience working with doctors at FamilyCare Medical Group. The following are two areas we are able to add value for doctors at FCMG. Agilon Health IPO This […]

National Grid Resources

Rockbridge and National Grid are both strongly rooted in the Syracuse community. As a result, Rockbridge has a significant number of clients who are employees of National Grid. Through our experience helping current clients, we have developed a level of expertise with National Grid’s benefits program. Discussed below are a few areas in which we’ve […]

How big are the largest American companies?

Somewhere between colossal and titanic. Apple, the largest publicly traded company in the world, has a market capitalization of $2.4 trillion. If it were its own country it would be slightly less valuable than all the publicly-traded stocks in Germany and slightly more valuable than those in South Korea. Microsoft is worth $2.2 trillion, a […]

Tax planning in turbulent times part 1: the tools of the tax-planning trade

Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome. No wonder people get nervous when there’s lots of talk about higher taxes, but little certainty on what may come of it, and who it might affect. How do we plan […]

The certain uncertainty of tax legislation

Tax planning is all about identifying opportunities that arise because of changes to a person’s tax situation from one year to the next. Many people think they do not need to consider tax planning because the information on their tax return does not change much year-to-year. Since the end of 2017, at least six new […]

We all want income – but cash is what we really need?

Some of us still yearn for a simpler time, when we could expect to retire and live comfortably on interest and dividend income from our investments. Protecting the principal of our nest egg would allow us to live many happy years without fear of running out of money. Of course we may still want to […]

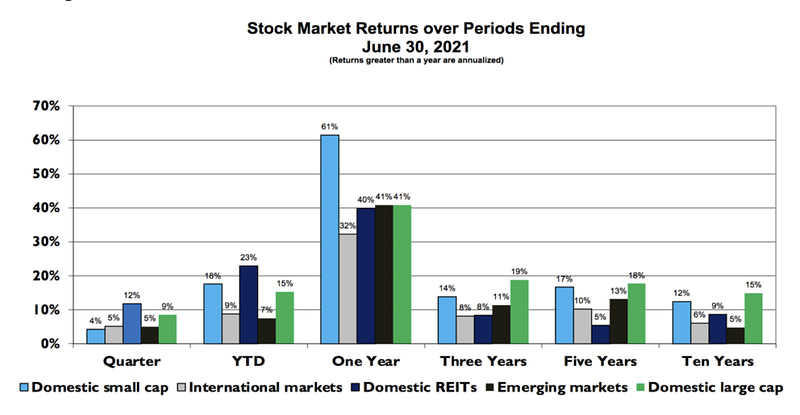

Market commentary: Q2 2021

Stock Markets: Stocks provided positive results over the most recent twelve-month period. While all markets have done well, especially stocks in domestic markets, the markets that lead and lag vary across the various periods. While not shown in this chart, a globally diversified stock portfolio earned over 12% over the three-year period ending June 30th, […]

The fed giveth, and the fed taketh away

Around the globe, COVID-19 killed millions of people, caused nearly 100 million to lose their job, and decreased economic output by several trillion dollars. When times get this bad, we investors are prepared to see losses in our portfolios. But in 2020 we saw the opposite. The S&P 500 was up 18%, almost double its […]

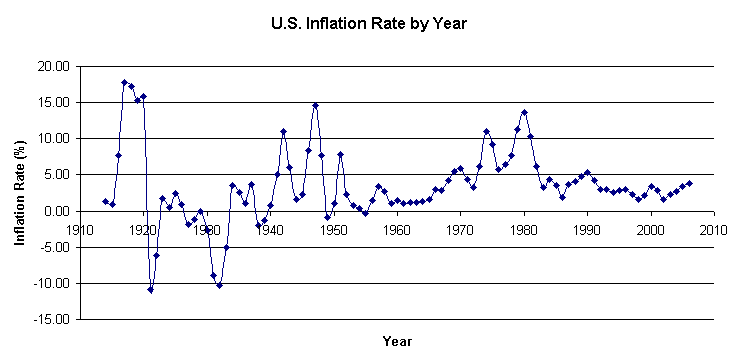

Is inflation haunting your financial dreams? Part 2: what we can do about it

In our last piece, we covered the recent uptick in inflation, and what to make of it in historical context. For investors, it’s important to take a step back and look at the big picture before acting on breaking news. But what if inflation does get out of hand, and stays that way for a […]