Is the Market Due for a Correction?

We have seen high returns and low volatility over the past three years. It feels like the stock market is due for a correction. Over the past three years returns have been much higher than average and volatility has been much lower than average. The chart below compares returns, and the variability in returns, for […]

Should You Manage Your Own Money?

Over the weekend, the Wall Street Journal writer Lindsay Gellman covered this important topic. She did an excellent job articulating the values of both hiring an advisor and managing your own personal finances. The sole point that I disagree with in the article is titled, “You won’t stick to a pro’s advice, anyway.” At […]

Observations for Investors from Preparing Taxes in 2014

More to Savings Bonds Than Just Interest: Savings bonds are perhaps the best interest-paying savings these days, with the banks paying little or no interest on savings and checking accounts and interest on CDs at an all-time low. Savings bonds are typically long-term savings. Several tax clients cashed in their long-term savings bonds in 2013, […]

Active or Passive?

In a recent Wall Street Journal (WSJ) article, the debate over whether to use active or passive investments was addressed. The conclusion was just use both! Let’s take a look at the five reasons they give to defend this neutral stance and see if they hold up to scrutiny. 1. Use index funds for efficient […]

Market Commentary April 2014

In the chart at right, we show returns from several equity market indices for periods ending March 31, 2014. After falling in January and bouncing back in February, domestic equity market returns ended the March quarter slightly positive; returns in the REIT market were especially strong. While exhibiting the same ups and downs as domestic […]

What is the Value of an Investment Advisor?

Does hiring an investment advisor improve your portfolio returns? This question is often on the minds of our clients or prospective clients. The value of an advisor is often easier to describe than define numerically. Many clients find value in hiring an advisor to provide “peace of mind” and comfort that a professional is watching […]

The Mythology of Dividend Paying Stocks

Myth – n. A fiction or half-truth, especially one that forms part of an ideology. (American Heritage Dictionary) Dividend paying stocks seem to have attained mythical proportions in recent years as people look for ways to coax income from their investment portfolios. The idea that dividend paying stocks are somehow superior to other stocks, or […]

Are 401(k) Fees Preventing Your Retirement?

The Atlantic published an article over the weekend on 401(k) fees that really resonated with me. With employer retirement plans being one of the largest sources of savings, it is disheartening to continually see high fee 401(k) plans. Below is the article. Let us know if your 401(k) fees are eating into your […]

SURPRISES AT TAX TIME

As a volunteer tax preparer for the AARP, I often review tax statements from many different brokers and investment companies. The Income Tax preparation process always seems to identify examples of the value of working with a trusted investment advisor. Here are some examples from my experiences as a volunteer tax preparer for AARP from […]

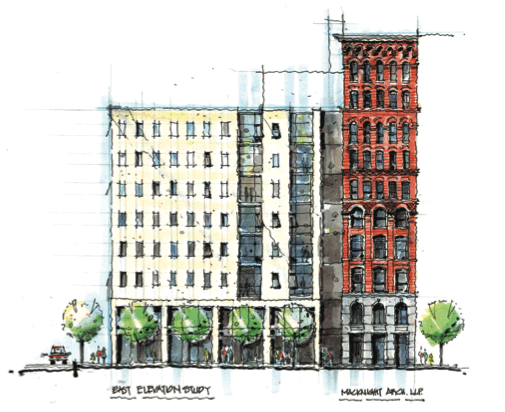

Rockbridge Is Moving!

New Office Location Our relocation to the Merchant Commons building has been postponed until February 1, 2014. Our new address will be: 220 S. Warren Street, 9th Floor Syracuse, NY 13202 We are very excited to be moving into this unique downtown Syracuse space that will accommodate our growth. “Merchants Commons is a modern, urban mixed-use […]