The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times that may feel uncomfortable in the stock market, it’s important to think about what we do know:

Bear Markets come and go quickly

From 1926-2021, the S&P 500 has experienced 17 bear markets. The average duration of each bear market was roughly 10 months. For long-term investors of all ages and stages of life- 10 months is a relatively short period of time in the grand scheme of things, and you are rewarded for staying invested during periods of uncertainty. Over the same period (1926-2021), the S&P 500 had an annualized return of ~10.5%.

Markets bounce back strong

An example we can all remember- the bear market that came with the start of the pandemic had a drop of over 20% by mid-March of 2020. Those who stayed the course for the remainder of the year saw their full account balances come back and continue to rally another ~20% by the end of the year.

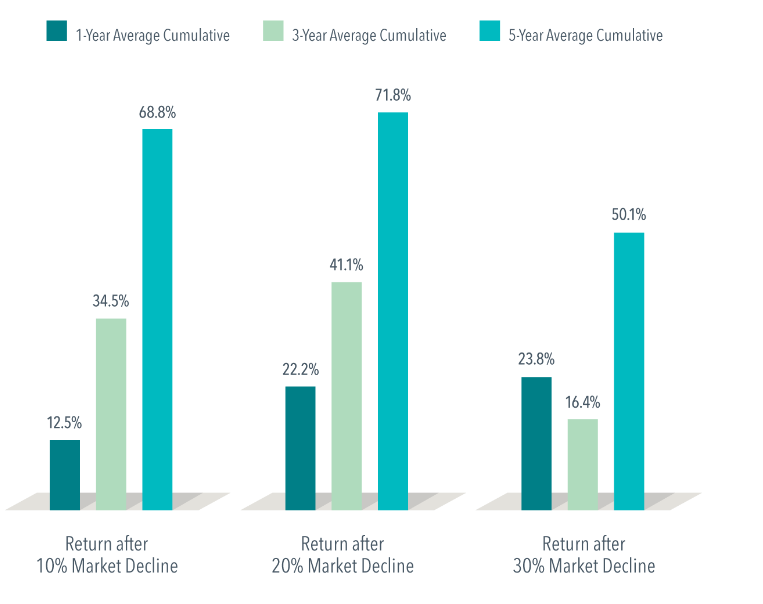

This is not an uncommon trend. From 1926-2021, the average 1-year return following a 20% market decline was ~22%, the 3-year following cumulative return was ~41%, and 5-year following cumulative return was ~72%. The graph below shows strong returns following 10% & 30% drops as well:

Conclusion

Bear markets are a part of being a market participant, and the only way you can hurt yourself in the long run is by making an emotional decision. At Rockbridge, we are advising all clients to stay the course, as we always have, and will continue to stick to our disciplined approach.

If you are still feeling uncomfortable or uncertain with your financial plan, schedule a time to chat with a Rockbridge advisor today!

Share

More Articles

Rockbridge Institutional – January 2026 Market Review

Diversification: Playing Defense and Offense

Retirement Plans for Business Owners

2026 Retirement Account and Contribution Limit Updates

Rockbridge Institutional – December 2025 Market Review

Rockbridge Institutional – November 2025 Market Review

Bear Markets – What do they mean for investors in the long-term?

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times that may feel uncomfortable in the stock market, it’s important to think about what we do know:

Bear Markets come and go quickly

From 1926-2021, the S&P 500 has experienced 17 bear markets. The average duration of each bear market was roughly 10 months. For long-term investors of all ages and stages of life- 10 months is a relatively short period of time in the grand scheme of things, and you are rewarded for staying invested during periods of uncertainty. Over the same period (1926-2021), the S&P 500 had an annualized return of ~10.5%.

Markets bounce back strong

An example we can all remember- the bear market that came with the start of the pandemic had a drop of over 20% by mid-March of 2020. Those who stayed the course for the remainder of the year saw their full account balances come back and continue to rally another ~20% by the end of the year.

This is not an uncommon trend. From 1926-2021, the average 1-year return following a 20% market decline was ~22%, the 3-year following cumulative return was ~41%, and 5-year following cumulative return was ~72%. The graph below shows strong returns following 10% & 30% drops as well:

Conclusion

Bear markets are a part of being a market participant, and the only way you can hurt yourself in the long run is by making an emotional decision. At Rockbridge, we are advising all clients to stay the course, as we always have, and will continue to stick to our disciplined approach.

If you are still feeling uncomfortable or uncertain with your financial plan, schedule a time to chat with a Rockbridge advisor today!