Tax Time – What to do with your refund?

Receiving a tax refund can be a great way to boost your savings, pay down debt, or invest in your future. But once you have that money in your pocket, where should you put it? Here are some of the best places to save a tax refund. Emergency fund An emergency fund is a crucial […]

Avoiding Surprises at Tax Time: The W-4 Form

The tax filing season can often be filled with angst as many filers are unsure whether they will receive a tax bill, a refund, or make it through unscathed. Fortunately, much of this stress can be avoided by properly filling out (or updating) your W-4 form. Employees are required to fill out their W-4 forms […]

Six Financial Best Practices for Year-End 2022

To say the least, there’s been plenty of political, financial, and economic activity this year—from rising interest rates to elevated inflation, to ongoing market turmoil. How will all the excitement translate into annual performance in our investment portfolios? Markets often deliver their best returns just when we’re most discouraged. So, who knows! While we wait […]

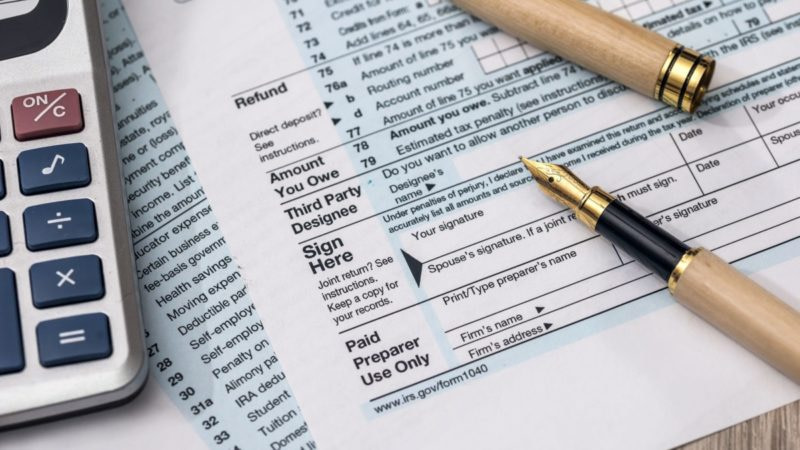

NYS Unemployment Fraud – What to do if you’ve been a victim?

During the pandemic, unemployment benefits were increased significantly to help alleviate the financial burden for those who found themselves out of work. An unfortunate outcome is that unemployment fraud has become much more common, and many people have unknowingly had unemployment benefits claimed against their Social Security number in 2021. The NYS Department of Taxation […]

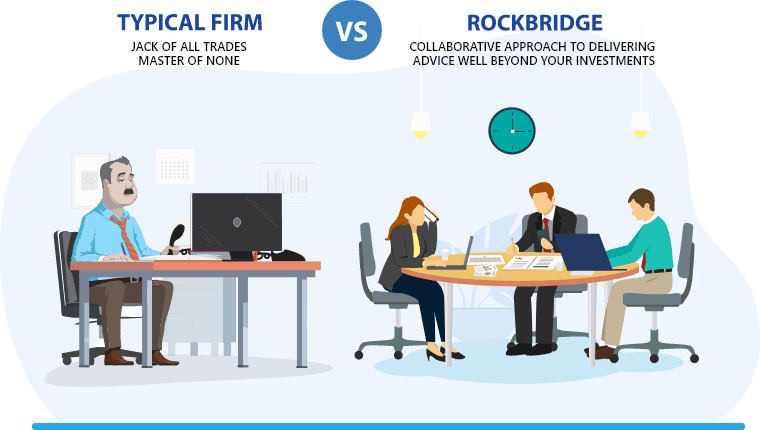

Fee-Only Advisor vs Fee-Based Advisor? What’s the difference?

As if the financial industry weren’t complicated enough, there are fee-only investment advisors and fee-based advisors — and a Registered Investment Advisor firm can be either. As the wording implies, fee-only investment advisors like Rockbridge receive NO commissions or any other forms of compensation from ANY outside sources. At the other end of the spectrum, commissioned brokers receive most or all of their […]

How to give to charity in the most tax-efficient manner

Whether it’s giving Tuesday or end-of-year outreach, many non-profits will be asking their supporters for donations as we head into holiday season & year-end. To our readers who are charitably inclined, first let us say thanks for your generosity helping those in need. We also want to make sure you are giving your money in […]

Inherited IRA Strategies Post-SECURE Act

Many people in the financial planning world referred to the SECURE Act as the “death of the stretch IRA” because of the new 10-year rule. The 10-year rule requires most non-spouse owners of inherited IRA’s to spend down the balance of their Inherited IRAs by the end of the 10th year. Beneficiaries may be forced […]

NYS tax update: PTET

If you itemize deductions on your federal tax return, you’ll recall that the 2017 tax law changes imposed a $10,000 cap on the amount of state income and property taxes (SALT) that you could deduct on your federal return. For many New York State taxpayers, this greatly reduced their federal itemized deductions and potentially forced them to […]

Syracuse Orthopedic Specialists Resources

Rockbridge works with several physicians in the Syracuse area, and more specifically, physicians employed at Syracuse Orthopedic Specialists. Through these experiences, Rockbridge has become well-versed with the benefit programs offered by SOS. Discussed below are two areas in which we have been able to add value to our clients employed by SOS. 401(k) Investment Options […]

National Grid Resources

Rockbridge and National Grid are both strongly rooted in the Syracuse community. As a result, Rockbridge has a significant number of clients who are employees of National Grid. Through our experience helping current clients, we have developed a level of expertise with National Grid’s benefits program. Discussed below are a few areas in which we’ve […]