Colleges, universities, and other not-for-profits are increasingly demanding that their investments support the effort to reduce climate impact and help grow the economy sustainably. Having a sustainable investment strategy has become imperative for nearly all investors.

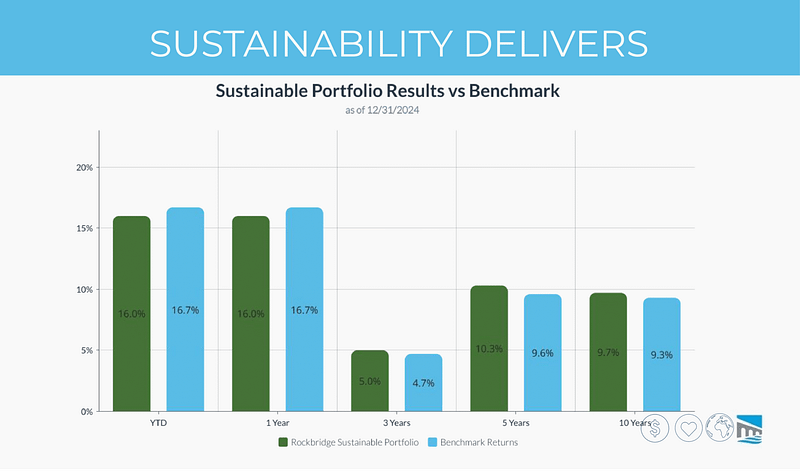

Many clients believe meeting their ESG investing goals means compromising on returns. At Rockbridge Institutional, we’ve demonstrated that sustainable portfolios can provide results consistent with market returns while remaining true to your organization’s mission and aligned with conservation principles and practices.

Rockbridge can incorporate sustainability considerations into building your institution’s investment portfolio while achieving long-term performance results. The tradeoffs are less than they ever have been before. Your investments could be doing more than just earning returns.

Excluding the worst companies and re-weighting to the best companies results in a significant decrease in the carbon intensity of an equity portfolio – a portfolio centered on measured outcomes.

The Rockbridge Sustainable Portfolio performs in line with comparable portfolios over the short and long term. There doesn’t appear to be any cost associated with pursuing an environmentally sustainable approach.

Rockbridge’s sustainability-centered investing allows our clients to:

1. Achieve returns that are consistent with the overall market.

2. Employ an investment philosophy that is consistent with their overall mission and values.