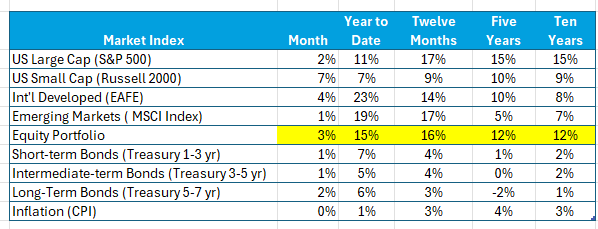

This month stocks are up; bond yields are down, shrugging off uncertainty. Here’s the data:

Note especially:

- Month and Year-to-date returns

- Returns in International Markets – both Developed and Emerging

- The S&P 500 Index

- Highlighted results of an equity portfolio

Stocks

Stocks continue to do well. Volatility remains subdued. The positive results in international markets have contributed to the equity portfolio. Notice that the S&P 500 did not lead the way this month.

Small cap stocks face more risk from tariffs and interest rate changes, which helps to explain the recent positive results as interest rates are expected to come down, although these stocks have lagged amid earlier increases in interest rates and tariff uncertainty.

Except for the US Large Cap market (S&P 500), which is dominated by tech stocks, five and ten-year results in other market indices are close to long-term averages; the S&P 500, on the other hand, is up 15% compounded annually over the past ten years, which is consistent with positive expectations for AI.

Note the variability in returns among various markets and how a diversified equity portfolio has behaved in the reported periods. Maintaining commitments to each market has been rewarding.

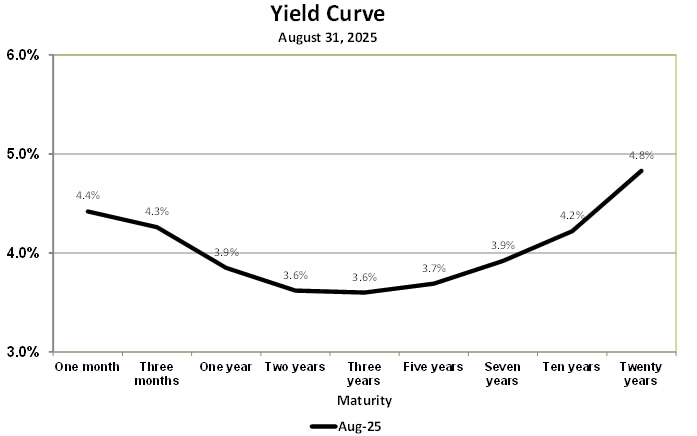

Bonds, Bond Yields, and Inflation

Bond yields are down over the month and year-to-date periods, producing positive returns. The bellwether ten-year US Treasury securities are down 0.4% since January.

Note the unusual “hammock” shape of today’s Yield Curve – downward sloping for maturities to three years (declining from 4.4% to 3.6%), then sloping upward. One story used to explain the shape of the Yield Curve at any point in time is that it reflects expected yields. For example, a one-year yield of 3.9% and a two-year yield of 3.6% implies a one-year yield one year from now declining to 3.4%. This expectation is consistent with the Fed reducing the Federal Funds rate. Look at the Curve beyond three-year maturities. It slopes upwards from 3.6% to 4.2% at ten-year maturities. The implication of this slope is that seven-year yields three years from now, will increase to 4.5%, which is consistent with rising inflation.

A Perspective on Recent Stock Markets

Markets “price” the future: sometimes too high, other times too low. However, there is evidence that in the long run, the highs and lows even out and investors earn the long-term averages. However, the swings between the highs and lows can be dramatic.

The S&P 500, which is overweighted with US Tech stocks is “pricing” expectations for AI. While AI will be transformative, its future is uncertain. Valuation metrics reflect a positive future for this technology, prompting a concern that perhaps there’s exuberance reflected in today’s prices.

The current upsurge in International Markets has brought returns over longer periods closer to long-term averages, as past returns in these markets have been well below past averages for some time.

While it is reasonable to be concerned that the domestic Large Cap market is currently oversold, it is not irrational, and other markets seem reasonably valued. Here’s some thoughts on what to do in this market environment:

- Remain diversified

- Rebalance to strategic allocations

- Avoid extrapolating short-term results

- Maintain a long-term view and enjoy the ride