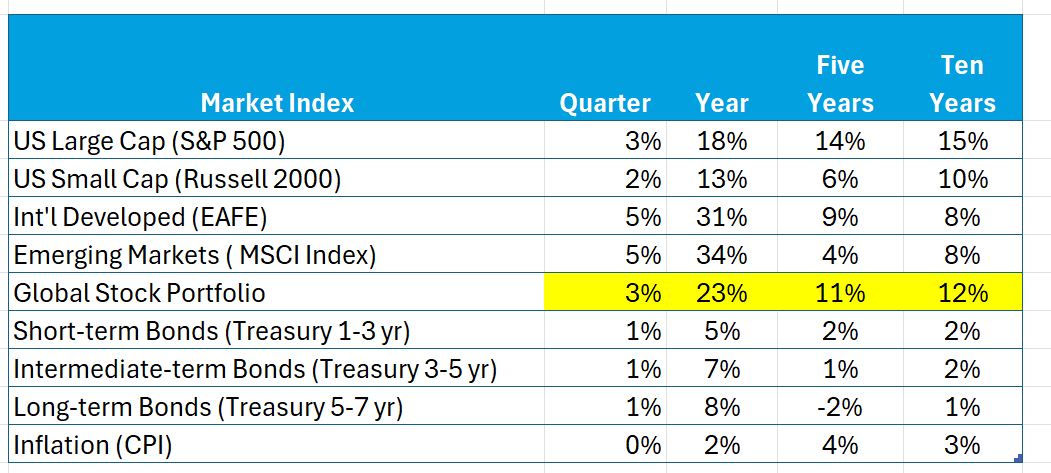

Notwithstanding ongoing predictions of a correction in AI stocks, markets turned in a good quarter and year. Here’s the data (periods ending December 31, 2025):

Note especially:

- Global stock portfolio returns (highlighted)

- Recent results in International Developed and Emerging markets

- S&P 500 returns

- One-year bond results

Stocks

Stocks surged amid concerns for a correction. The S&P 500, which is a reasonable proxy for AI, continues to push ahead. The Magnificent Seven portfolio (a widely followed group of AI stocks representing 37% of the index) was about flat for the quarter and up 19% over the past year. Volatility in the S&P 500 remained subdued – while up a bit in November, the VIX index (an indicator of market expectation of S&P volatility) has fallen to the year’s lows as returns climbed.

While the S&P 500 has certainly enjoyed a good run recently, it is not unprecedented. Over the last more than fifty years, one-third of the twelve-month returns exceed this year’s 18%.

Diversification was key to the positive results of our global portfolio in recent periods. The S&P 500 (Magnificent Seven) was a contributor in earlier periods then, as these stocks rested, International Developed markets and Emerging markets picked up the slack. Holding commitments to both markets throughout had a positive impact on a diversified stock portfolio.

Bonds, Bond, Yields, and Inflation

Bonds in the past quarter and year-to-date periods not only reduced volatility but also contributed to the returns of a diversified portfolio. Bond returns over longer periods reflect increasing yields.

Bond yields are a reasonable proxy for expected inflation. Long-term yields include a measure of the cost of money and expected inflation. Today’s yields signal that inflation is generally in check – over the next five to ten years approximately 2.5% – within shouting distance of the Fed’s stated objectives.

All eyes are on the Fed. What it does with short-term interest rates is less important than signals for how it trades off its twin objectives of employment and inflation over longer periods. The Fed responds not only to an uncertain economic landscape, but also political pressure creating another source of uncertainty.

Anticipated Correction?

The end of the year is a time when many commentators unsheathe their crystal ball and tell us what the market will bring for next year. Predictions make investing easy. Will Rogers tells us how: “Don’t gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it.” Unfortunately, adopting this strategy rarely results in good long-term outcomes.

Changes in market prices over time reflect new information, which not only is a surprise, but also comes randomly. The challenge is to make sound decisions with the highest probability for a successful outcome in this environment. Here are some thoughts: First, invest in assets that will produce a future cash flow and are traded in a well-functioning market. This requirement rules out cryptocurrency! Next, form a well-diversified portfolio based on how these assets are expected to behave in terms of returns, variability, and correlations – factors gleaned from past behavior that describe, not predict, market behavior. Rebalance back to established commitments periodically, carefully measure results, endure the ups and downs and enjoy the benefits of compound interest, which Warren Buffett describes as the Eighth Wonder of the World.