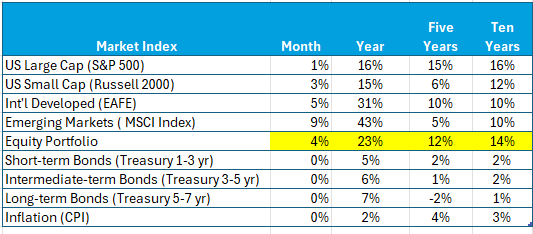

Notwithstanding the volatility from political uncertainty, stocks continued to surge ahead this month, especially in non-domestic markets. Here’s the data for periods ending January 2026:

Note:

- Variability among this month’s returns

- Recent results from international markets

- Global stock portfolio returns in all periods

Stocks

This month a global stock portfolio reflects results from more than technology stocks. The widely quoted capital-weighted S&P 500 returned 1%, under other indices. On the other hand, the equally weighted S&P 500 earned nearly 3%, reflecting the contribution of non-AI stocks. Note how other markets have picked up the slack in recent periods, demonstrating the value of diversification. A Magnificent Seven portfolio was a drag on the index, losing nearly 1%. However, a monthly loss of this amount reflects the usual noise in capital markets; it is not in “correction” territory.

Stocks trading in non-domestic markets continue to reward and contribute meaningfully to a diversified equity portfolio. While care must be taken not to extrapolate short periods into the future, after languishing well below domestic markets for some time, recent results are certainly welcomed. Much of the emerging market results reflect contributions from investments of AI in South Korea.

Gold prices are surging, which is not surprising given the level of global uncertainty. Gold is neither a medium of exchange, nor a unit of account. It produces no cash flow. The only reason to purchase gold is the hope that someone will buy it at a higher price – pure speculation, not investing.

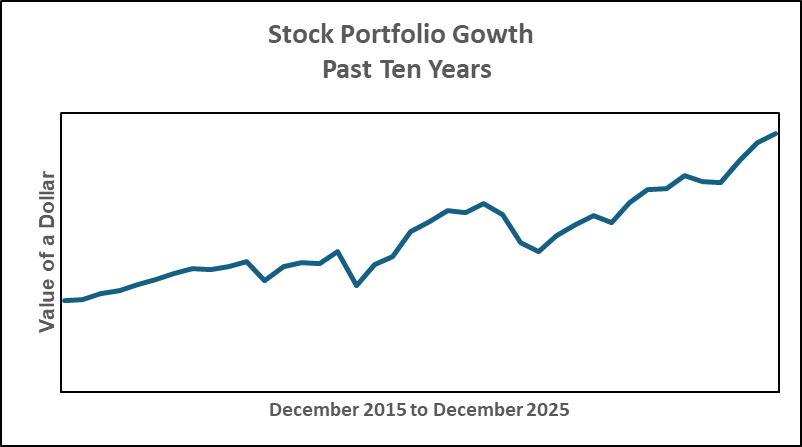

The most recent ten years has been a wonderful period for stocks, a diversified equity portfolio returned 14%. However, it was not a smooth ride and required “staying the course” throughout some down markets as the accompanying chart above will attest. Maintaining commitments in volatile markets requires discipline.

Bonds

There was little change in bond yields this month resulting in an essentially flat bond market. Bonds continue to shrug off increasing deficits and the politicization of the Fed. The controversy surrounding the Chairman brings a new level of uncertainty. Little reaction from the market to Kevin Warsh. A variety of opinions on this choice – we’ll see.

Bond yields include a measure of expected inflation. The Fed can reduce short-term rates only; the market determines longer-term rates, which reflect uncertainty (risk) and expected inflation. If increased politicization of the Fed increases risk and expected inflation, rates will go up regardless of how it moves on short-term rates.

Risk-Aversion

A key assumption necessary to understand the workings of capital markets is that decisions are made by risk-averse investors. This simply means that an expected return from an investment is sufficient compensation for its risk. Relaxing this risk-aversion assumption is apt to result in mispricing risk and distorting prices.

Risk-averse investors don’t purchase lottery tickets, engage in sports betting, invest in private equity, gold, or bitcoin, all of which have a risk-adjusted negative expected payoff. Yet massive amounts of money are attracted to these opportunities. If this non-risk-averse activity spills over to capital markets, risk-aversion no longer explains its behavior. Market prices reflect the marginal (last) trade, which if not made by risk-averse investors can distort market signals.