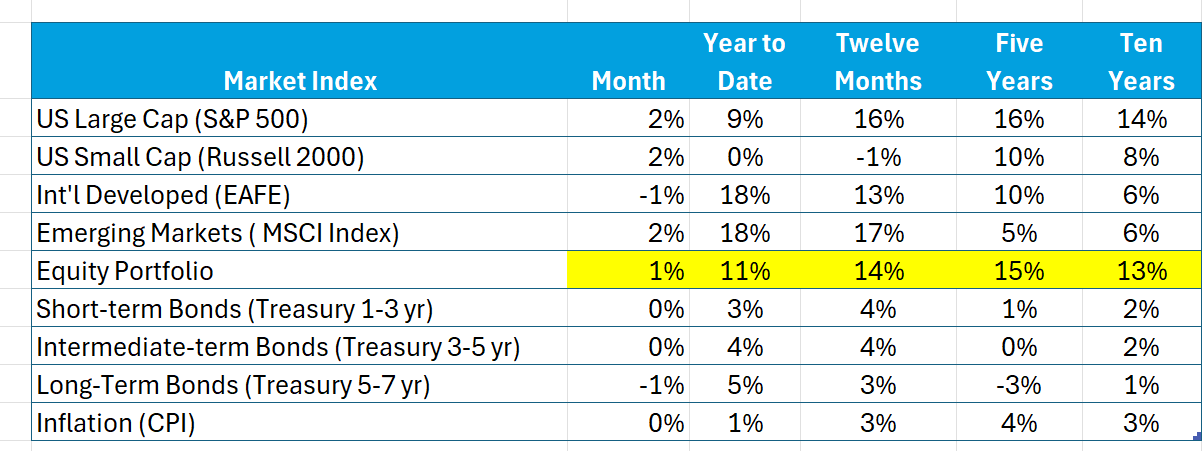

Stocks provide solid results to investors – diversification is important. Here’s the data:

Note especially:

- Recent stock market returns

- International Market returns – Developed and Emerging

- Returns of the S&P 500 Index

- Results of a diversified equity portfolio

Stocks

While recent days remind us that stocks are volatile, even with ongoing political uncertainty and the ups and downs in tariff implementations, investments in stocks continue to be rewarded. Look at the highlighted equity portfolio results above. Solid annual returns ranging from 11%-15% in each of several recent periods. Except for a sharp uptick around the time tariffs were first announced, the VIX index (a measure of the volatility implied in options for the S&P 100 index) has remained at historic levels.

Allocations to non-domestic markets have paid off in recent periods. Year-to-date the index for International Developed Markets (EAFE) and Emerging Markets (MSCI Index) both earned 18%, well above the comparable returns for domestic market indices. The international results are helped by the decline in the value of the dollar, which means non-US earnings gain when converted into dollars (Nominal Broad U.S. Dollar Index down 7% since the first of the year).

The Magnificent Seven stocks (Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla) are a significant part of the S&P 500 Index and a proxy for investments in AI. While explaining much of the above-average results over longer periods, year-to-date returns are mixed – Apple is down 19%, Meta and Nvidia are up about 30%, producing a year-to-date average of 6%.

All in all, the data provides a picture of a reasonably comfortable period for stocks. Yet, the past couple of days confirm complacency should be avoided. Looking ahead, concerns for the eventual implementation and economic impact of tariffs remain. While AI is sure to be transformative, the link to stock prices is uncertain.

Bonds and Inflation

Yields were up a bit across all maturities in July. Consequently, bond returns were flat to down, depending on maturity. Year-to-date and over the trailing-twelve-months yields were down, producing a positive environment for bond returns. Over the 5- and 10-year periods bond returns reflect rising interest rates and yields.

Observed yields are the sum of expected inflation and time value of money. The yield on the 10-yr bellwether Treasury is currently 4.4%. The comparable inflation-adjusted yield (time value of money) is 1.9% – while above what we have been used to, this measure of the time value of money is reasonable from a longer perspective.

While it is expected that tariffs will increase prices eventually, inflation has remained in check. The CPI was up 1.2% year-to-date and 2.5% over the past year. The spread between nominal and inflation- adjusted yields implies inflation of 2.5% over the next 10 years.

Turmoil at the Fed

The Fed Chairmanship is in the news. Much of the controversy is the extent to which the Fed seeks to reduce interest rates. At its recent meeting they decided to keep the Federal Funds rate at current levels until its September meeting. Keep in mind that the Fed controls only the short-term Federal Funds rate directly. While all eyes are on the Fed, it’s the market-determined longer-term rates that have economic impact.