Market Review

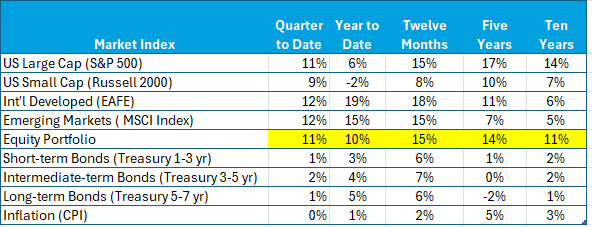

Markets continue to shrug off any turmoil. Here’s the data for periods ending June 30, 2025: Note especially:

- The positive stock market returns this quarter

- That equity risk was rewarded in all periods

- Recent nondomestic market returns

- Inflation

Stocks

Stocks continue to look beyond today’s uncertainties for now. In the June quarter both domestic and international equity markets turned in positive results – domestic markets went up better than 9%, international markets went up more than 12%. Volatility remains subdued. While year-to-date domestic small cap markets are down, nondomestic markets have picked up the slack.

International stock markets benefited from the decline in the value of the dollar. The Nominal Broad U.S. Dollar Index is off nearly 8% in the last six months, reflecting increased uncertainty in the US bond market, as well as tariff uncertainty and turmoil at the Fed.

The S&P 500 incorporates the results of the AI-driven so-called Magnificent Seven (Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla). After a sharp falloff in the first quarter (down 16%) an equally weighted portfolio of these stocks came back nicely (nearly 20%) this quarter, bringing the year-to-date consolidated results to about a wash. AI valuations remain high; be cautious extrapolating the recent past.

Stocks so far are resilient amid the turmoil of Mideast Wars, tariff implementation, the political environment, and deficit financing. Markets respond to financial and economic uncertainties; political turmoil seems to have had little impact on prices.

Bonds

Bond returns reflect declining yields at short and intermediate term maturities – little change in 10-Yr. yields. Inflation remains in check. Not only is the CPI close to Fed targets, but also expectations gleaned from the spread between longer-term nominal and inflation-adjusted yields imply that it will remain so. The latest from the Fed is that it’s keeping rates at current levels and adopting a “wait and see” approach to further changes.

Risk and Uncertainties

Diversification to include commitments to non-domestic markets has helped returns recently. For example, after providing above average returns in the recent past, domestic markets have been more subdued so far this year, while international markets have picked up the pace. Holding commitments to both markets has rewarded investors with lower volatility. Even among the Magnificent Seven, returns do not move together – Apple is down nearly 17%, while Meta is up over 23% so far this year. Holding both means less risk – seeking to predict a winner is a risky “fool’s errand.”

Diversification has been called the only “free lunch” in investing – more upside without more risk. By holding assets with uncorrelated returns, risk is reduced without reducing expected returns. In well-functioning markets, return and risk are positively related. However, it is not reasonable to expect a reward for taking unnecessary risks, which are avoided with diversification.

Because expected return is not what’s realized in the short run, staying committed to diversification strategies is difficult. Unless we can predict short-term results, which few can do consistently, with the assurance that expected returns are eventually realized, the investment focus is on expected long-term returns, not short-term random noise.

Political turmoil notwithstanding, stocks and bonds are behaving reasonably well. However, enough uncertainties remain to continue to be cautious.