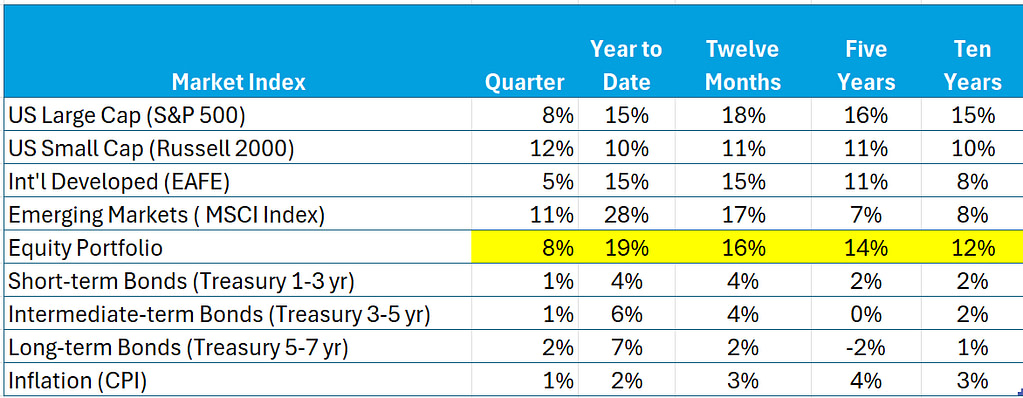

Note especially:

- Returns of the equity portfolio

- S&P 500 returns

- Recent returns from International Markets

- Year-to-date bond returns

Stocks

Stocks continue to reward investors. Look at the returns from our equity portfolio – 19% year-to-date. Diversification across several markets contributed to these positive results. Yet, uncertainties remain, including the implementation and impact of tariffs, stock valuations, eventual payoff from massive AI investments, turmoil at the Fed, the path of interest rates, and Government shutdowns, all of which stock markets seem to be shrugging off.

Returns of the S&P 500 are well above past averages. Thirty-five percent of this index is the Magnificent Seven stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) that are a reasonable proxy for expectations for AI. Consequently, the robust returns reflect the current enthusiasm for the future of AI and anticipate the eventual payoff of AI infrastructure investments.

Returns from international market indices are well above averages and have contributed to the results of our diversified equity portfolio. After periods of below-average results in these markets, the 10-year returns are close to long-term averages.

Stock returns are well above reasonable expectations. Take care not to extrapolate the recent past far into the future.

Bonds, Bond Yields, and Inflation

The year-to-date bond returns reflect declining yields. Concern about an economic slowdown prompted the Fed to drop its Federal Funds rate by 0.25% to 4.25%. The yield of the bellwether 10-year Treasuries fell to 4.15% (from 4.29% at the beginning of the quarter). The shape of the Yield Curve anticipates declining interest rates in the near term, then moves upward.

Inflation is up a bit – the CPI increased from 1.2% at the beginning of the quarter to 1.8% today. The spread between nominal and inflation-adjusted yields, a reasonable measure of market expectations for longer-term inflation, although above Fed targets, remained in check (2.4% for 5-year maturities).

Magnificent Seven Valuation

Markets “price” the future – sometimes too high, other times too low; the swings can be dramatic and unexplainable. Current prices of the Magnificent Seven have some recalling Alan Greenspan’s description of “irrational exuberance.” Traditional measures of value reflect this concern.

PE ratio (the ratio of current stock price to earnings) is one traditional measure of value. The current PE ratio of the Magnificent Seven is 30 times next year’s predicted earnings. This PE ratio is high, not only compared to historical averages, but also well above what is implied by analysts’ earnings predictions. Currently, analysts are predicting a weighted average five-year earnings growth of 15% for the Magnificent Seven, well below what would justify today’s lofty PE ratios. Consequently, for our measures of value to be at traditional levels, either growth must be well above these predictions or values must fall significantly.

Of course, there is significant uncertainty with the future benefits of AI, which many are suggesting could be massive. Consequently, today’s values might be warranted. While we must take care not to bet against market signals, current valuation metrics indicate unbounded optimism for the Magnificent Seven stocks – not necessarily “irrational,” but surely “exuberant.”