FamilyCare Medical Group – Agilon IPO & 401(k) Options

Rockbridge works with over 120 medical professionals, most of whom are in the Syracuse area. In addition to the expertise we’ve developed with providers, we have experience working with doctors at FamilyCare Medical Group. The following are two areas we are able to add value for doctors at FCMG. Agilon Health IPO This […]

National Grid Resources

Rockbridge and National Grid are both strongly rooted in the Syracuse community. As a result, Rockbridge has a significant number of clients who are employees of National Grid. Through our experience helping current clients, we have developed a level of expertise with National Grid’s benefits program. Discussed below are a few areas in which we’ve […]

How big are the largest American companies?

Somewhere between colossal and titanic. Apple, the largest publicly traded company in the world, has a market capitalization of $2.4 trillion. If it were its own country it would be slightly less valuable than all the publicly-traded stocks in Germany and slightly more valuable than those in South Korea. Microsoft is worth $2.2 trillion, a […]

The certain uncertainty of tax legislation

Tax planning is all about identifying opportunities that arise because of changes to a person’s tax situation from one year to the next. Many people think they do not need to consider tax planning because the information on their tax return does not change much year-to-year. Since the end of 2017, at least six new […]

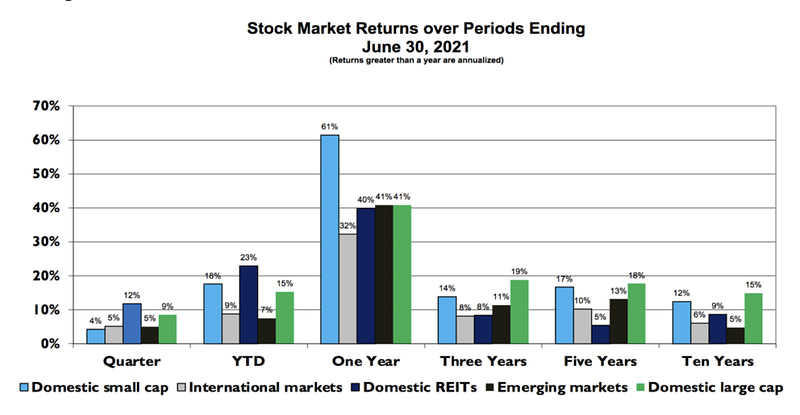

Market commentary: Q2 2021

Stock Markets: Stocks provided positive results over the most recent twelve-month period. While all markets have done well, especially stocks in domestic markets, the markets that lead and lag vary across the various periods. While not shown in this chart, a globally diversified stock portfolio earned over 12% over the three-year period ending June 30th, […]

The fed giveth, and the fed taketh away

Around the globe, COVID-19 killed millions of people, caused nearly 100 million to lose their job, and decreased economic output by several trillion dollars. When times get this bad, we investors are prepared to see losses in our portfolios. But in 2020 we saw the opposite. The S&P 500 was up 18%, almost double its […]

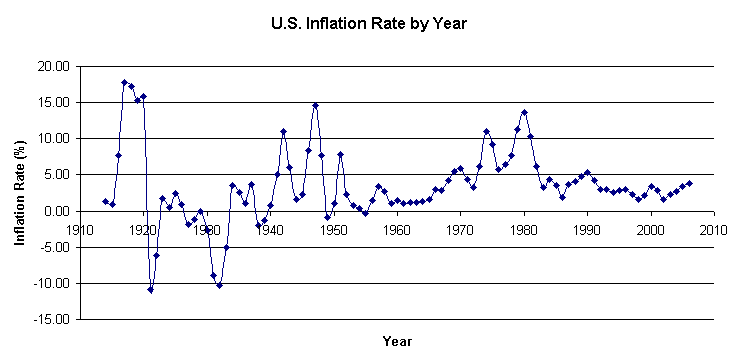

Is inflation haunting your financial dreams? Part 2: what we can do about it

In our last piece, we covered the recent uptick in inflation, and what to make of it in historical context. For investors, it’s important to take a step back and look at the big picture before acting on breaking news. But what if inflation does get out of hand, and stays that way for a […]

Protecting what’s yours (after you pass) Part 1: the importance of estate planning

Fact: When you pass, you will leave behind an estate, and somebody will need to settle it. Your estate may be worth a little or a lot, but there’s no escaping death and taxes. So why do so many families put off their essential estate planning until push comes to shove? Estate Planning Is an […]

Why value stocks do better with rising interest rates & inflation

Year to date returns for Value stocks have exceeded that from Growth stocks across all market caps, both domestically and abroad. There are several reasons for this. US Vaccination rates have been greater than expected, which has helped traditional companies (value) at the expense of technology companies (growth). Company specific earnings have likely made a […]

Lockheed Martin 401(k) plan fund changes

Lockheed Martin announced a change to their current 401(k) plan lineup. Aside from some funds being renamed, the major changes are: Retiring the Global Real Estate Fund. This eliminates exposure to REIT’s in the plan unless you invest in a Target Date Fund Retiring the Emerging Markets Indexed Equity Fun. This change eliminates exposure to […]