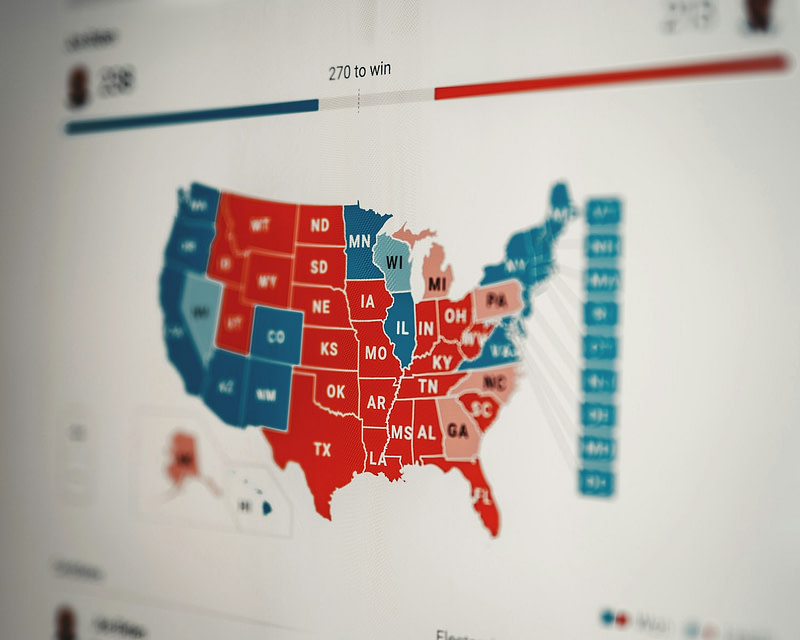

Politics and Your Portfolio: Why Diversification is Your Best Defense

In the wake of U.S. elections, emotions often run high — especially when it comes to how political outcomes might affect financial markets. Financial Planning magazine asked 320 advisors “how will the US election outcome influence your retirement plan?” A staggering 90% anticipated a negative impact on their clients’ portfolios. This survey was from 2016, […]

How to Improve your Credit Score

Your credit score is more than just a number; it’s a critical component of your financial picture. A high credit score can unlock lower interest rates on loans, better credit card offers, and even impact your ability to rent an apartment or acquire a motor vehicle. Here are some actionable steps to take if you’re […]

Market Indifference: How Presidential Elections Impact Your Portfolio

With the 2024 presidential election coming up, many investors wonder how the outcome could affect their investment portfolios. Historically, there has been a perception that Republican presidents are better for the stock market, while Democratic presidents are better for the bond market. However, statistics shows that the market responds indifferently to which party wins the […]

Maintaining Equity Exposure in the Current Interest Rate Environment

In today’s interest rate environment, some investors are tempted to lock in “guaranteed” returns through fixed income instruments yielding 5% or more. However, investing solely in fixed income would be a mistake for most long-term investors. Discussed below are a few reasons why that is the case: Higher Long-Term Returns Over the past 90 years, […]