Retirement Plan Contribution Limits & Other Tax Changes for 2022

Every year the IRS reviews a variety of retirement plan contribution limits and other important fiscal boundaries. Here’s a list of changes made effective January 1st, 2022. Item 2021 2022 401(k) Employee Max $19,500 $20,500 401(k) Catch Up $6,500 $6,500 401(k) Total Max $58,000 $61,000 HSA (Individual) $3,600 $3,650 SIMPLE IRA $13,500 $14,000 SIMPLE IRA […]

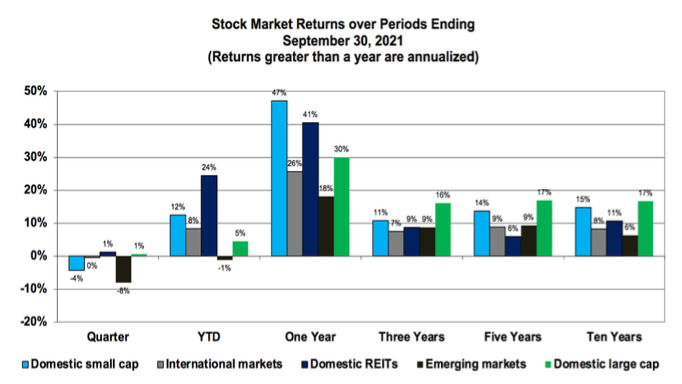

Things to be Thankful For: Stock Market Returns, Not Bank Interest

Over the last 90 years, the stock market has been great to investors. No one knows what the market will do tomorrow, but the longer your horizon, the more the odds are in your favor – and you don’t have to wait very long for the numbers to look pretty good. With bank interest close […]

Rockbridge becomes Upstate NY’s only “Recommended Advisor” by the White Coat Investor

We are happy to announce we have joined 34 other Advisory firms from around the country who are labeled “Best Financial Advisors for Physicians” by the White Coat Investor. Who is the White Coat Investor? Jim Dahle is a practicing emergency physician in Utah. After several bad experiences with financial professionals, he developed a passion […]

How to give to charity in the most tax-efficient manner

Whether it’s giving Tuesday or end-of-year outreach, many non-profits will be asking their supporters for donations as we head into holiday season & year-end. To our readers who are charitably inclined, first let us say thanks for your generosity helping those in need. We also want to make sure you are giving your money in […]

Market Commentary: Q3 2021

Stock market returns were mixed in the third quarter. Microsoft, Google and Apple led returns in the domestic large-cap stock market; stocks traded in international developed markets and REITs were also positive. The riskier domestic small-cap and emerging market stocks posted negative results, which dragged a portfolio diversified among all these markets down over 2% […]

Inherited IRA Strategies Post-SECURE Act

Many people in the financial planning world referred to the SECURE Act as the “death of the stretch IRA” because of the new 10-year rule. The 10-year rule requires most non-spouse owners of inherited IRA’s to spend down the balance of their Inherited IRAs by the end of the 10th year. Beneficiaries may be forced […]

Build Back Better Act – Other Proposed Changes

Last week I wrote an article that dove into what the Build Back Better Act could mean for those currently using the Backdoor Roth IRA strategy. While that is a significant change that could be on the horizon, it is only one of many currently proposed in the several hundred-page plan. Shown below is a […]

Q&A – Social Security

Ethan Gilbert, CFA®, CFP®, was recently featured in a short Q&A on The Street’s “Ask Bob”. Shown below is what was asked, as well as Ethan’s answer to the question: Question: My husband wanted me to ask you something. He is 65 and will be 66 on October 16th this year. At what age […]

Build Back Better Act – Backdoor Roths

The year-end process can be stressful for many investors and 2021 is no different in terms of having proposed changes to the federal tax code. The proposed Build Back Better Act is currently structured to limit those who can use the “Backdoor Roth” strategy and/or make Roth Conversions in general. We don’t know if this […]

Exelon Resources

As Rockbridge continues to grow, so does the number of client relationships we have with employees of Exelon, mainly at the nuclear plant in Oswego, NY. Through working with employees of Exelon, we have developed an expertise for providing advice on Exelon’s employee benefits. Discussed below are a few areas in which we’ve added value […]