The fed giveth, and the fed taketh away

Around the globe, COVID-19 killed millions of people, caused nearly 100 million to lose their job, and decreased economic output by several trillion dollars. When times get this bad, we investors are prepared to see losses in our portfolios. But in 2020 we saw the opposite. The S&P 500 was up 18%, almost double its […]

Is inflation haunting your financial dreams? Part 2: what we can do about it

In our last piece, we covered the recent uptick in inflation, and what to make of it in historical context. For investors, it’s important to take a step back and look at the big picture before acting on breaking news. But what if inflation does get out of hand, and stays that way for a […]

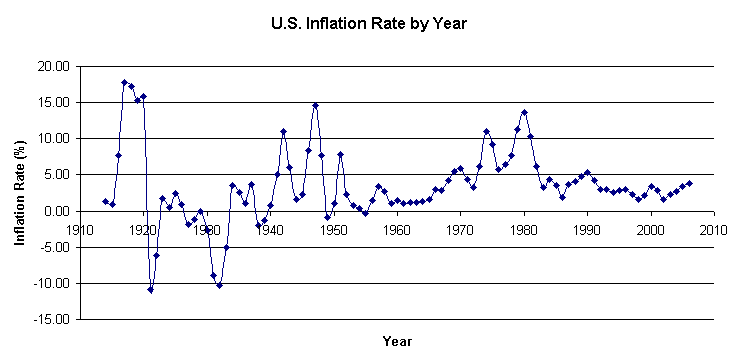

Is inflation haunting your financial dreams? Part 1: what we know

Has the specter of inflation got you spooked? Recent headlines are filled with sightings. In this two-part series, let’s take a closer look at what to make of all the commentary, and what you can do about it as an investor. First and foremost, we caution against succumbing to fear or panic in the face […]

The january effect was strong this year

In Syracuse, we see lake effect snow every January. But there’s another sizable “effect” in January if you know where to look. This one’s in the stock market. The “January Effect” is the outperformance of small-cap stocks versus large-cap stocks in the first month of the year. Going back to 1926, small companies have rallied […]

Great results, but greater expectations

Last week we saw some of the largest tech companies in the world report their earnings from the first quarter of 2021 and the numbers were impressive. Headlines on CNBC read: “Apple reports blowout quarter, booking more than $100 billion in revenue for the first time” “Tesla posts record net income of $438 million, revenue […]

Protecting what’s yours (after you pass) Part 1: the importance of estate planning

Fact: When you pass, you will leave behind an estate, and somebody will need to settle it. Your estate may be worth a little or a lot, but there’s no escaping death and taxes. So why do so many families put off their essential estate planning until push comes to shove? Estate Planning Is an […]

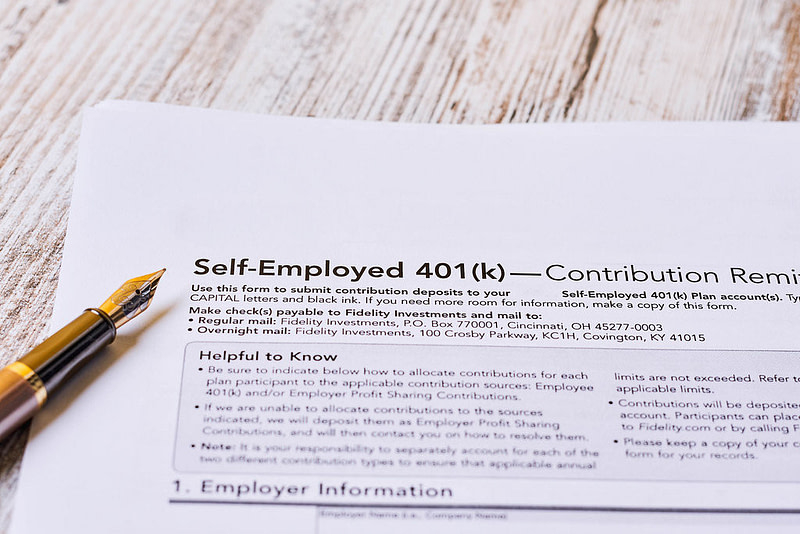

Solo 401k- 3 reasons why every business owner should consider one!

For self-employed business owners, you’re responsible for saving for your own retirement. It’s likely that you got a late start at saving and maybe even had to leverage yourself to get your business up and running. SEP IRA? SIMPLE? 401k? Solo 401k…I get it, you are busy running your business and the last thing […]

Why value stocks do better with rising interest rates & inflation

Year to date returns for Value stocks have exceeded that from Growth stocks across all market caps, both domestically and abroad. There are several reasons for this. US Vaccination rates have been greater than expected, which has helped traditional companies (value) at the expense of technology companies (growth). Company specific earnings have likely made a […]

Market commentary: Q1 2021

Stock Markets Stocks continued to climb in the first quarter and these results are signaling a robust economy ahead. Markets have made a dramatic rebound since the sharp fall in the first quarter last year. Look at the returns over the past twelve months in the chart to the right. Also note that stocks traded […]

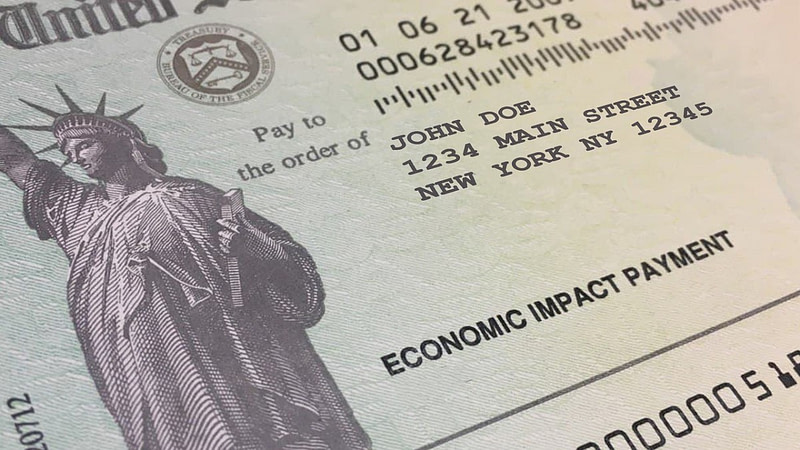

The American rescue plan act of 2021: understanding the 2021 recovery rebate stimulus payments

The American Rescue Plan Act of 2021 is now a done deal. Among the items of greatest interest to most Americans is a third round of stimulus checks – or IRS “recovery rebates” – of up to $1,400 for every “eligible individual.” That’s the quick take. But what’s the fine print? How Much Will You […]