Rockbridge Institutional – November 2023 Market Review

Investing in the “Magnificent Seven” Now the leading high-tech companies are the “Magnificent Seven” (those of a certain age will relate). These companies – Apple, Alphabet (Google), Amazon, Meta (Facebook), Microsoft, Nvidia, and Tesla – make up about 30% of the S&P 500 index. While it is a stretch to expect an investor is lucky […]

Rockbridge Institutional – October 2023 Market Review

Interest Rate Risk in Bonds Rapidly rising interest rates explain bond market losses in recent periods. The Bloomberg U.S. Aggregate Bond Index, a reasonable proxy for the U.S. bond markets, is off 4% over the past three months, confirming that bonds are risky. Bond risk is from two sources primarily – credit risk and interest […]

Maintaining Equity Exposure in the Current Interest Rate Environment

In today’s interest rate environment, some investors are tempted to lock in “guaranteed” returns through fixed income instruments yielding 5% or more. However, investing solely in fixed income would be a mistake for most long-term investors. Discussed below are a few reasons why that is the case: Higher Long-Term Returns Over the past 90 years, […]

Changes for Unused Funds from 529 Plans Beginning in 2024

To address investor concerns related to 529 Plan savings going unused, a provision of SECURE ACT 2.0 allows the opportunity to rollover unused 529 education savings into a Roth IRA in the beneficiary’s name, penalty free. As a result, investors should feel a sense of relief about leftover 529 savings that weren’t used for education. […]

S&P 500

Adam Gagas Chief Investment Officer October 3, 2023 The S&P 500 Index is often thought of as a proxy for the US stock market. In truth, the S&P 500 is an index that represents only a narrow slice of the domestic marketplace. Recently, the index is showing signs of getting even narrower by two important […]

Estate Planning Awareness Month

October is Estate Planning Awareness Month, which serves as an important reminder for all of us to take time to review our estate plans or create one if we haven’t already. Estate planning is not just for the wealthy or elderly – it’s important for everyone to have a plan in place to protect your […]

Commentary from Fed Meeting (September, 2023)

Each month, the Federal Open Market Committee (FOMC) issues its position on the current economic conditions and outlook on future forecasts and projections. The main areas of focus are inflation, unemployment and interest rates. Here are a few takeaways from Chairman Jerome Powell’s press conference: As predicted, the FOMC voted to hold the federal […]

Rockbridge Institutional – August 2023 Market Review

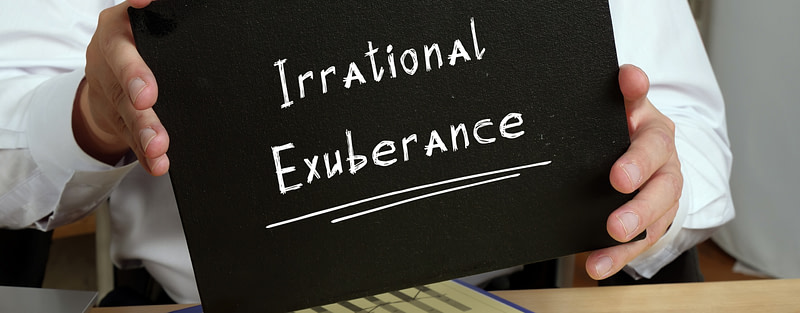

“Irrational Exuberance” and Market Pricing The price of Nvidia stock, a software design and development firm that manufactures chips integral to the gaming industry and, consequently, a proxy for Artificial Intelligence (AI), skyrocketed from $142 per share on December 30 to $494 per share today – a gain of over 230%. Does this increase in […]

SAVE – Student Loan Repayment Program

With over 28 million borrowers of Federal student loans resuming payments following a multi-year hiatus, the Biden-Harris Administration released a new income-driven repayment (IDR) plan. Known as the Saving on a Valuable Education (SAVE) plan, this IDR approach calculates monthly payments according to a borrower’s income and family size, ultimately forgiving any outstanding balances after […]

IRS Delays Roth Catch-Up Requirement for High Income Earners

There was some good news from the IRS recently for high-income earners making catch-up contributions to their employer-sponsored retirement plans. The IRS recently issued a notice that they will be postponing one of the new rule changes under Secure 2.0 Act. If you recall, the Act was going to require high-income earners (individuals making over $145,000/year) over […]