The Fed Has Been Busy

The Federal Reserve has significantly altered their guidance in the last few months. The biggest change is the increase in the expected number of rate hikes this year. In December, the Fed was expecting three rate hikes in 2022. Three weeks ago, they increased that forecast to 7, and the market is now expecting 8. […]

How the Conflict in the Ukraine affects Investors

The war that began this week between Russia and the Ukraine is a human tragedy and a stark reminder that dollars and cents are secondary to health and safety. Some of us who have friends and family in the areas affected by war are focused on the wellbeing of their loved ones. But for most […]

Major Firms predict Expected Returns in the coming Decade

Every year large Wall Street firms publish their forecast of expected returns for the coming decade. The following table shows what each firm expects from capital markets in the coming 10-years. The first thing that jumps out is the poor expected performance by U.S. equities. Despite averaging nearly 10% over the last 100 years, forecasters […]

Rockbridge Spotlight: Disciplined Capital Management

Rockbridge is excited to welcome Adam Gagas, Sharon Craig, and Jodi DeAugustine of Disciplined Capital Management (DCM) to the Rockbridge team. Rockbridge and DCM decided to consolidate businesses and advisory teams this past October. The combination is a natural fit because the two firms share a common heritage and investment philosophy that dates back three […]

Market Commentary: Q4 2021

2021 was a good year for domestic stocks, with large-cap stocks (S&P500) up 29%. Returns in this market segment continue to be driven by the largest tech stocks, which had been the case for the last ten years. Results in other markets are mixed.REITs produced extraordinary returns bouncing back from last year’s sharp fall-off. Emerging […]

Tax Scams

As we head into a new year and with it, a new tax season, we wanted to draw attention to a number of scams and schemes to defraud unsuspecting taxpayers. We think it is important that our clients be aware of how these scams work, and what precautions you can take to protect yourself. How […]

Retirement Plan Contribution Limits & Other Tax Changes for 2022

Every year the IRS reviews a variety of retirement plan contribution limits and other important fiscal boundaries. Here’s a list of changes made effective January 1st, 2022. Item 2021 2022 401(k) Employee Max $19,500 $20,500 401(k) Catch Up $6,500 $6,500 401(k) Total Max $58,000 $61,000 HSA (Individual) $3,600 $3,650 SIMPLE IRA $13,500 $14,000 SIMPLE IRA […]

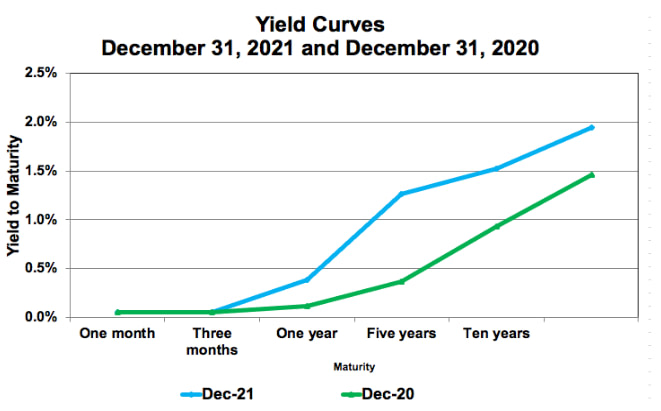

The Fed’s new path and what it means for Investors

The Federal Reserve met in December and outlined a new course for monetary policy going forward. They signaled two big changes: The Fed will stop buying Treasury Bonds and Mortgage-Backed Securities by March The Fed expects to raise interest rates 3 times next year, bringing the Fed Funds rate from a target of 0.00% – […]

Things to be Thankful For: Stock Market Returns, Not Bank Interest

Over the last 90 years, the stock market has been great to investors. No one knows what the market will do tomorrow, but the longer your horizon, the more the odds are in your favor – and you don’t have to wait very long for the numbers to look pretty good. With bank interest close […]

Rockbridge becomes Upstate NY’s only “Recommended Advisor” by the White Coat Investor

We are happy to announce we have joined 34 other Advisory firms from around the country who are labeled “Best Financial Advisors for Physicians” by the White Coat Investor. Who is the White Coat Investor? Jim Dahle is a practicing emergency physician in Utah. After several bad experiences with financial professionals, he developed a passion […]