Interest Rate Outlook – November 2022

In early November, the Fed raised interest rates by 75 bps, marking the sixth rate hike since March 17th, 2022, and four consecutive .75 bps increases. This puts the Fed Funds rate (the short-term rate guiding overnight lending) up to a range of 3.75% to 4.00%, pushing borrowing costs to a new high since 2008. […]

How Do We Choose the Funds We Use?

Does it seem like there’s been an extra level of uncertainty lately, threatening your investment plans? Of course, there are always big events going on; that’s the world for you. But today’s brew of geopolitical threats, inflation trends, rising interest rates, recessionary fears, and lingering COVID concerns may feel especially daunting. The market’s volatile reactions […]

Market Commentary: Q1 2022

Stock Markets Not surprisingly, stock markets were volatile this quarter. Faced with a myriad of issues ranging from renewed inflation, historically high equity valuations, winding down the Fed’s “Quantitative Easing”, capped by Russia’s invasion of Ukraine. The largest tech companies held up reasonably well, with Facebook as the only notable exception. Returns from stocks traded […]

Things to be Thankful For: Stock Market Returns, Not Bank Interest

Over the last 90 years, the stock market has been great to investors. No one knows what the market will do tomorrow, but the longer your horizon, the more the odds are in your favor – and you don’t have to wait very long for the numbers to look pretty good. With bank interest close […]

2020 active vs. passive

Each year the financial services company, Morningstar, issues a report of how actively managed funds performed relative to passive funds. Historically, actively managed funds have not performed as well as funds designed to simply replicate a market or published index. However, one argument active fund managers make is that they are “nimbler” during times of […]

How big are the largest American companies?

Somewhere between colossal and titanic. Apple, the largest publicly traded company in the world, has a market capitalization of $2.4 trillion. If it were its own country it would be slightly less valuable than all the publicly-traded stocks in Germany and slightly more valuable than those in South Korea. Microsoft is worth $2.2 trillion, a […]

The fed giveth, and the fed taketh away

Around the globe, COVID-19 killed millions of people, caused nearly 100 million to lose their job, and decreased economic output by several trillion dollars. When times get this bad, we investors are prepared to see losses in our portfolios. But in 2020 we saw the opposite. The S&P 500 was up 18%, almost double its […]

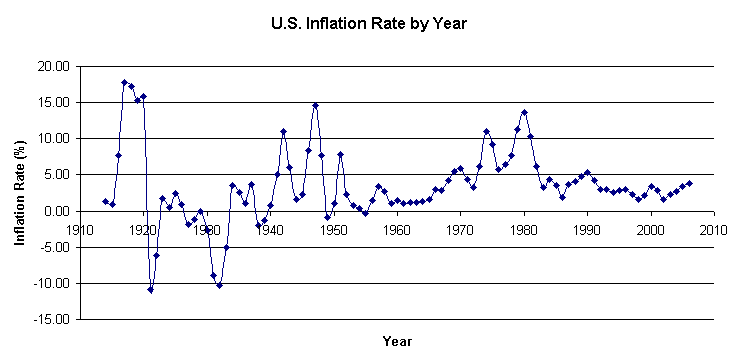

Is inflation haunting your financial dreams? Part 2: what we can do about it

In our last piece, we covered the recent uptick in inflation, and what to make of it in historical context. For investors, it’s important to take a step back and look at the big picture before acting on breaking news. But what if inflation does get out of hand, and stays that way for a […]

The january effect was strong this year

In Syracuse, we see lake effect snow every January. But there’s another sizable “effect” in January if you know where to look. This one’s in the stock market. The “January Effect” is the outperformance of small-cap stocks versus large-cap stocks in the first month of the year. Going back to 1926, small companies have rallied […]

Great results, but greater expectations

Last week we saw some of the largest tech companies in the world report their earnings from the first quarter of 2021 and the numbers were impressive. Headlines on CNBC read: “Apple reports blowout quarter, booking more than $100 billion in revenue for the first time” “Tesla posts record net income of $438 million, revenue […]