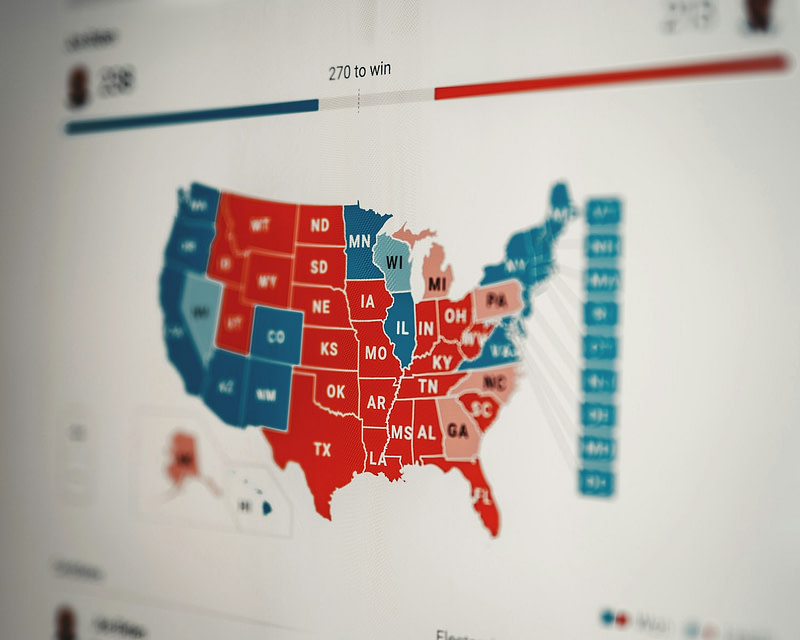

Market Indifference: How Presidential Elections Impact Your Portfolio

With the 2024 presidential election coming up, many investors wonder how the outcome could affect their investment portfolios. Historically, there has been a perception that Republican presidents are better for the stock market, while Democratic presidents are better for the bond market. However, statistics shows that the market responds indifferently to which party wins the […]

Bank Run News

It’s hard, and often counterproductive to comment about breaking news while it’s still moving through the proverbial grinder … which is why we usually don’t do so. However, we feel it’s worth commenting on the current, growing number of regional bank runs. Before taking a look at the details, we’ll lead with two larger assurances: […]

Silicon Valley Bank Commentary

The Silicon Valley Bank failure that occurred late last week caused a flurry of news articles and speculation that have driven down bank stocks across the board. Investors may be concerned about the implications, but it’s important to understand the facts and how they may or may not affect individual investors and more importantly, Rockbridge […]

How the Conflict in the Ukraine affects Investors

The war that began this week between Russia and the Ukraine is a human tragedy and a stark reminder that dollars and cents are secondary to health and safety. Some of us who have friends and family in the areas affected by war are focused on the wellbeing of their loved ones. But for most […]

The Fed’s new path and what it means for Investors

The Federal Reserve met in December and outlined a new course for monetary policy going forward. They signaled two big changes: The Fed will stop buying Treasury Bonds and Mortgage-Backed Securities by March The Fed expects to raise interest rates 3 times next year, bringing the Fed Funds rate from a target of 0.00% – […]

State of the Labor Market

Covid-19 didn’t just bring volatility to the stock market, it also brought volatility to the labor market. The number of unemployed quadrupled from 5.7 million (3.5%) in February 2020 to 23.1 million (14.8%) in April 2020. Not surprisingly, the number of job openings decreased from 7.1 million to 4.6 million at that same time. Fortunately, […]

Build Back Better Act – Other Proposed Changes

Last week I wrote an article that dove into what the Build Back Better Act could mean for those currently using the Backdoor Roth IRA strategy. While that is a significant change that could be on the horizon, it is only one of many currently proposed in the several hundred-page plan. Shown below is a […]

Build Back Better Act – Backdoor Roths

The year-end process can be stressful for many investors and 2021 is no different in terms of having proposed changes to the federal tax code. The proposed Build Back Better Act is currently structured to limit those who can use the “Backdoor Roth” strategy and/or make Roth Conversions in general. We don’t know if this […]

What does it mean to short a stock and what’s going on with GameStop?

GameStop has been in the news in the last week as the share price jumped from $35 to $350, and is up from an April intraday low of $2.57. There are lots of things going on with this but the one getting the most attention is the “short squeeze.” We’re going to describe what a […]

Deductibility of business expenses paid for with PPP funds

Congress created the Paycheck Protection Program (PPP), to provide liquidity to small businesses dealing with the effects of the economic shutdown. It was clear from the language in the CARES Act that loans used for covered expenses would not be included in a business’ gross income. However, the Bill was silent on the deductibility of […]