Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

March 16, 2016

AllNewsRetirement

As you may have heard, there have been some drastic changes to Social Security regarding the file-and-suspend and restricted application methods of filing. These changes were announced back in October 2015 when Congress passed their 2016 budget. (You can read more about the specifics of these changes in this article.)

As expected, there has been much confusion surrounding the changes – from Social Security recipients and Social Security Administration employees alike. The criteria regarding who is still eligible for these strategies is specific and complex, which leads people to discuss their eligibility with a professional. However, according to a recent Wall Street Journal article, there have been several instances where people have been given incorrect information regarding their eligibility from the Social Security Administration.

“People who turn 66 by April 29 can still file for Social Security and suspend their benefits to allow a spouse to file a restricted application, as long as they act by that date. Doing so can make sense if your spouse was 62 or older by January 1 of this year because people in that age group will continue to be able to file a restricted application for only a spousal benefit once they turn 66. With such a coordinated strategy, one spouse can pocket the spousal benefit while both delay claiming their own benefits to take advantage of the delayed retirement credits that increase monthly payments by 6% to 8% for each year in which claiming is deferred between ages 66 and 70.”

The article sites one case where a couple – the husband is 66 and the wife is 64 – was told by a Social Security office in California that they could not participate in the strategy because they both needed to be 66 years old. Since this is incorrect, the couple’s financial advisor told them to be persistent. The couple filed-and-suspended the husband’s benefit over the objections of the Social Security agent and were accepted. According to their advisor, the couple could have lost over $100,000 in lifetime benefits if they had not insisted.

The Social Security Administration says that it has made an effort to inform the over 30,000 employees through manuals, training and other methods of instruction since the beginning of 2016. They recommend that if you are having trouble at an office to ask for a supervisor or a technical officer. Filing online is a great option as well.

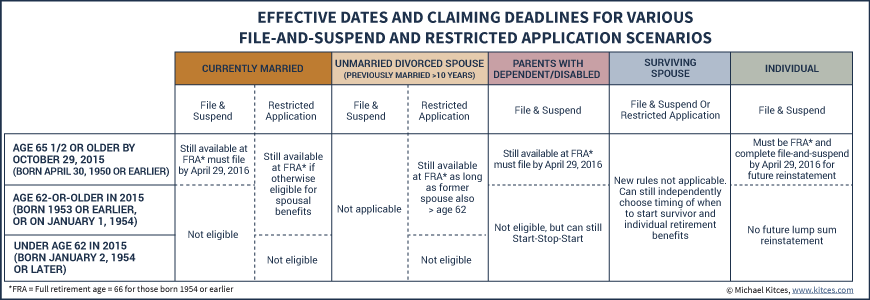

You can always contact your advisor at Rockbridge with any questions regarding Social Security. Below is a chart of the claiming deadlines, and different scenarios regarding eligibility.

Source of chart: Michael Kitces at Nerd’s Eye View. You can read Michael’s article regarding the Social Security changes here.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.