Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 15, 2014

All

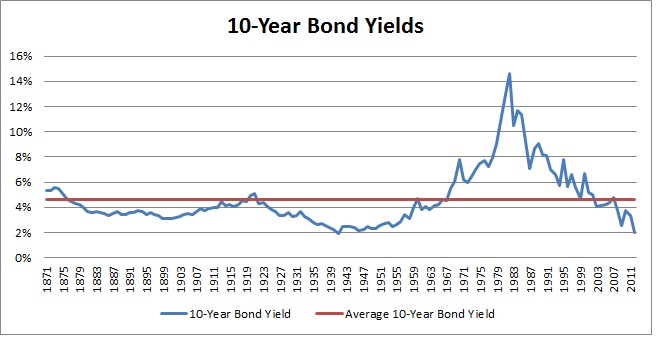

Ten-year Treasury rates continue to stay at historic lows following the “Great Recession” of 2008. The prevailing sentiment is that rates will climb as the economy continues to recover. On the other hand, it is important to give this view a historical context. There have been times where long-term bond yields have remained below average for extended periods. An interesting graph appeared in the Enterprising Investor blog for the CFA Institute (“Three Charts that Will Rekindle Your Interest in Financial Market History” by William Ortell). My interest was in a graph of the historic yields of the Ten-year Treasury security.

Using data from Robert Shiller (2013 Nobel Memorial Prize winner in Economic Sciences), I constructed the graph at right of interest rates. Long-term bond rates averaged approximately 4.6% over the available history, which is magnified by the high inflationary environment of the 1970’s and 80’s. However, it is interesting to note that there was a 20-year period beginning in the 1930’s where rates stayed in the sub 3% range, which is where rates are today.

We must be wary of the chance that rates could remain low for a long time, and possibly go lower. Much will depend on the Fed’s actions and the overall economy.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.