Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 22, 2018

AllInvestingNews

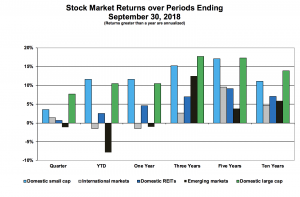

For the last quarter, stocks are up except for Emerging Markets, which were close to flat. Domestic stocks are seemingly shrugging off the uncertainties of increasing interest rates, trade wars and tariffs.

Year to date, an Emerging Market stock portfolio would be down almost 9%. It is not surprising that today’s uncertainties are having a greater impact on developing economies as they tend to have larger debt levels denominated in dollars and exports are a bigger part of their economies. Consequently, the value of the dollar is increasing, interest rates are rising, and tariffs will have a greater impact.

Non-U.S. markets have not kept pace with U.S. markets over the periods presented. Subsequently, stock returns from a globally diversified portfolio over these periods would be below those of the popular domestic indices (e.g. S&P 500). This environment makes maintaining commitments across all markets especially hard. The benefits of diversification are clear, but it often means enduring periods of below average results in various markets for extended periods of time. For example, since 1971 the annualized ten-year return for the S&P 500 has varied between 5% and 17%. It is reasonable to think markets will eventually earn their expected returns (in the “long-term”), but this variability gets in the way of considering ten years the “long-term”, as we would expect a much tighter range in these results if it were indeed the long-term. So, when we see non-U.S. stocks underperform in every period reported in the chart above, we do not conclude they will always underperform, but instead that more patience is required to reach the “long-term” and achieve expected returns.

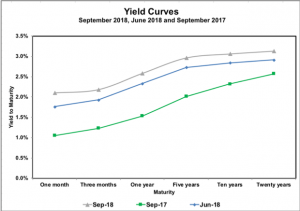

The Yield Curves to the right shows that bond yields ticked up for all maturities over the past year and quarter. The Fed recently affirmed its commitment to increase interest rates and the change in yields is consistent with that objective.

How much room is left for bond yields to move? The yield on the 10-year Treasury is currently about 3.1%. Theoretically, a bond’s yield should include a premium for (1) the time value of money, (2) risk and (3) expected inflation. For example, let’s pick 2% as a premium for investing instead of spending money. Note the difference in yield between one-year and ten-year bonds is 0.5%. This leaves 0.6% as expected inflation over the next ten years. If this expected inflation number is reasonable, then today’s yields might be about right – if this number for expected inflation over the next ten years feels low, then yields might have some ways to go. While these observations are not a prediction, they are intended to provide some con text for what we see in today’s bond markets.

text for what we see in today’s bond markets.

As we think about the recent bull market in U.S. stocks, below-average results in non-U.S. markets, and historical low interest rates, keep in mind that markets have no memory. Remember that prices are based on expectations not the past.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.