Rockbridge Institutional – October 2022 Market Review

MARKET COMMENTARY Stocks Except for emerging markets, stocks were up in October. Domestic markets led the way – large cap (S&P 500) up 9%; small cap (Russell 2000) up 11%. International developed markets (EAFE Index) were up 5%, while emerging markets (MSCI Index) were off 3% due to sharply negative results in China. While uncertainty […]

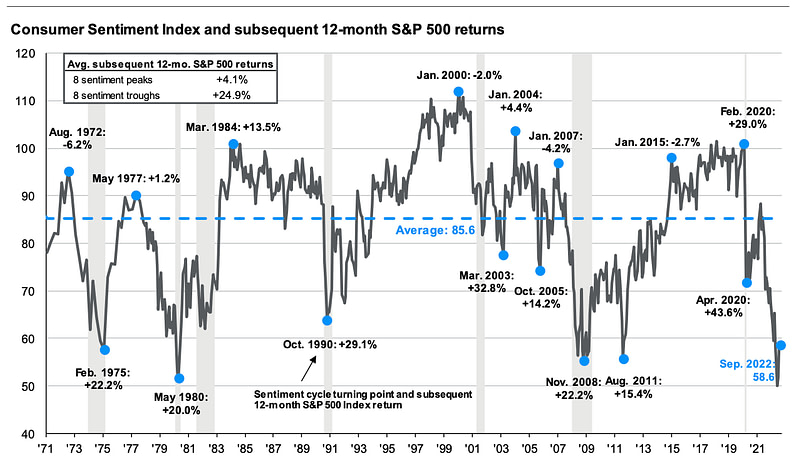

Consumer Sentiment Vs Market Returns

It’s safe to say that both, market prices and investor confidence have taken a hit since the start of the year. Heading into 2022, we had experienced three years of S&P 500 performance averaging over 20% annually- not to mention this was all while dealing with a global pandemic. Since then, the S&P 500 has […]

Capital Market Activity (September, 2022)

August saw significant up and downs in stock returns. In the first half of the month a global stock portfolio was up about 3%, then dropped 6% to a loss of almost 3% after Fed Chairman Powell publicly reaffirm its commitment to increasing interest rates until inflation is in check. Domestic large cap equities were […]

Fee-Only Advisor vs Fee-Based Advisor? What’s the difference?

As if the financial industry weren’t complicated enough, there are fee-only investment advisors and fee-based advisors — and a Registered Investment Advisor firm can be either. As the wording implies, fee-only investment advisors like Rockbridge receive NO commissions or any other forms of compensation from ANY outside sources. At the other end of the spectrum, commissioned brokers receive most or all of their […]

Capital Market Activity (August, 2022)

After a sharp decline in the first six months of this year, stocks were up nicely in July; a global equity portfolio was up just over 6%. These results were a welcome respite from what we have experienced thus far this year. Markets look to the future. Let us hope they signal positive expectations for […]

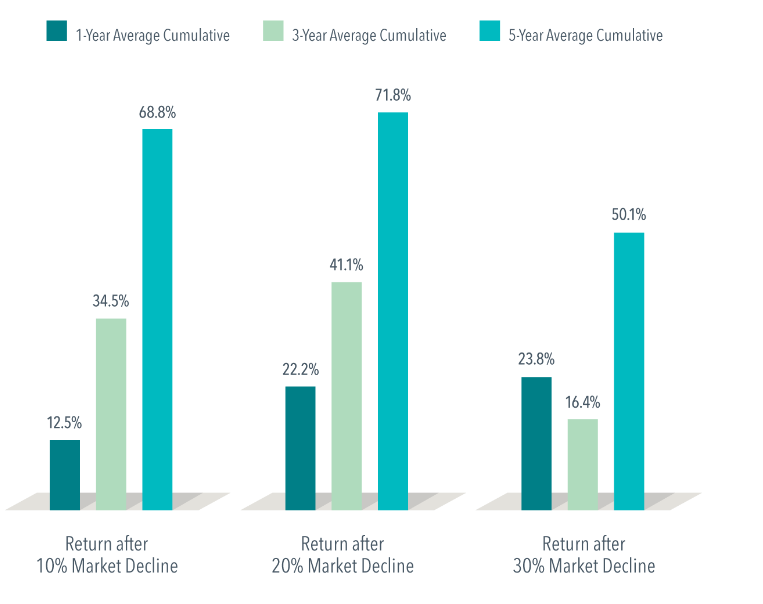

Bear Markets – What do they mean for investors in the long-term?

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]

Market Commentary: Q1 2022

Stock Markets Not surprisingly, stock markets were volatile this quarter. Faced with a myriad of issues ranging from renewed inflation, historically high equity valuations, winding down the Fed’s “Quantitative Easing”, capped by Russia’s invasion of Ukraine. The largest tech companies held up reasonably well, with Facebook as the only notable exception. Returns from stocks traded […]

The Fed Has Been Busy

The Federal Reserve has significantly altered their guidance in the last few months. The biggest change is the increase in the expected number of rate hikes this year. In December, the Fed was expecting three rate hikes in 2022. Three weeks ago, they increased that forecast to 7, and the market is now expecting 8. […]

Retirement Plan Contribution Limits & Other Tax Changes for 2022

Every year the IRS reviews a variety of retirement plan contribution limits and other important fiscal boundaries. Here’s a list of changes made effective January 1st, 2022. Item 2021 2022 401(k) Employee Max $19,500 $20,500 401(k) Catch Up $6,500 $6,500 401(k) Total Max $58,000 $61,000 HSA (Individual) $3,600 $3,650 SIMPLE IRA $13,500 $14,000 SIMPLE IRA […]

The Fed’s new path and what it means for Investors

The Federal Reserve met in December and outlined a new course for monetary policy going forward. They signaled two big changes: The Fed will stop buying Treasury Bonds and Mortgage-Backed Securities by March The Fed expects to raise interest rates 3 times next year, bringing the Fed Funds rate from a target of 0.00% – […]