Ignore the Headlines

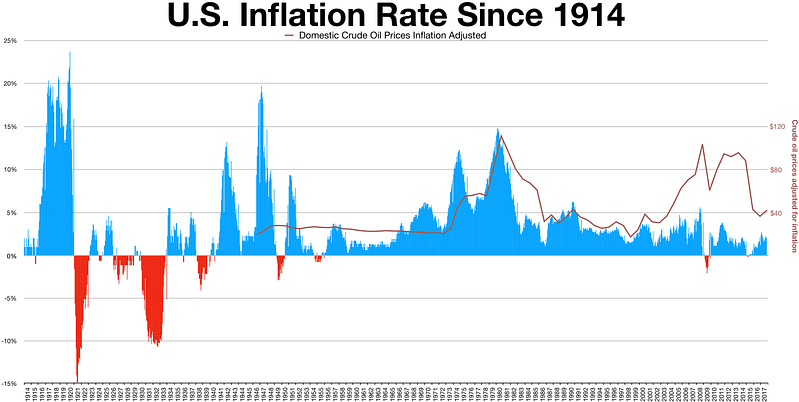

Recent headlines have been dramatic as “Inflation Soars to Highest level in 40 Years!” and “Stocks Plunge to 2022 Lows!” It sounds like the authors are all shouting, and we should really panic. It feels like we should “do something” but let’s take a step back from the headlines, and put today’s market in perspective […]

Capital Market Activity – 05/31/2022

Stock Markets Although rebounding lately, all markets are down year to date. Since December stock markets are off more than 10%. Tech stocks are especially hard hit – an equally weighted portfolio of the largest domestic tech stocks (Apple, Microsoft, Amazon, Google, and Facebook) is off 25%. The premium to value markets, domestic and international, […]

How Do We Choose the Funds We Use?

Does it seem like there’s been an extra level of uncertainty lately, threatening your investment plans? Of course, there are always big events going on; that’s the world for you. But today’s brew of geopolitical threats, inflation trends, rising interest rates, recessionary fears, and lingering COVID concerns may feel especially daunting. The market’s volatile reactions […]

Major Firms predict Expected Returns in the coming Decade

Every year large Wall Street firms publish their forecast of expected returns for the coming decade. The following table shows what each firm expects from capital markets in the coming 10-years. The first thing that jumps out is the poor expected performance by U.S. equities. Despite averaging nearly 10% over the last 100 years, forecasters […]

2020 active vs. passive

Each year the financial services company, Morningstar, issues a report of how actively managed funds performed relative to passive funds. Historically, actively managed funds have not performed as well as funds designed to simply replicate a market or published index. However, one argument active fund managers make is that they are “nimbler” during times of […]

How big are the largest American companies?

Somewhere between colossal and titanic. Apple, the largest publicly traded company in the world, has a market capitalization of $2.4 trillion. If it were its own country it would be slightly less valuable than all the publicly-traded stocks in Germany and slightly more valuable than those in South Korea. Microsoft is worth $2.2 trillion, a […]

We all want income – but cash is what we really need?

Some of us still yearn for a simpler time, when we could expect to retire and live comfortably on interest and dividend income from our investments. Protecting the principal of our nest egg would allow us to live many happy years without fear of running out of money. Of course we may still want to […]

The january effect was strong this year

In Syracuse, we see lake effect snow every January. But there’s another sizable “effect” in January if you know where to look. This one’s in the stock market. The “January Effect” is the outperformance of small-cap stocks versus large-cap stocks in the first month of the year. Going back to 1926, small companies have rallied […]

Great results, but greater expectations

Last week we saw some of the largest tech companies in the world report their earnings from the first quarter of 2021 and the numbers were impressive. Headlines on CNBC read: “Apple reports blowout quarter, booking more than $100 billion in revenue for the first time” “Tesla posts record net income of $438 million, revenue […]

Why value stocks do better with rising interest rates & inflation

Year to date returns for Value stocks have exceeded that from Growth stocks across all market caps, both domestically and abroad. There are several reasons for this. US Vaccination rates have been greater than expected, which has helped traditional companies (value) at the expense of technology companies (growth). Company specific earnings have likely made a […]