Ready to get started?

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.

October 12, 2018

AllInvestingNews

We had several clients this year reach out to ask how bonds were performing in their portfolios. These are great questions, so we created a few items to address what you see in your statements. Some people notice they have held bonds for several years but seem to have a loss with their holding. This may come from their monthly statement from the custodian. Below is an example of how that looks:

From looking at this statement, it seems this investor has lost almost $9,000 from their bond holdings in the last 2.5 years (1/25/16 to 7/31/18). However, if you look at the returns from the bond funds over that period you see they were positive.

This is possible because the bond funds pay interest every month. That interest goes into the account as a monthly cash deposit and is used when we rebalance the portfolio. Interest paid in cash does not increase the market value column. Despite showing an unrealized loss, the investor did make money through these holdings.

All that said, bonds can lose money. When interest rates rise, the value of existing bonds goes down, and returns can be negative even when accounting for interest payments.

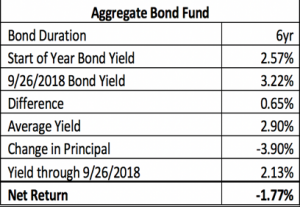

An aggregate bond fund holds thousands of bonds. In their entirety, they have an average weighted life (duration) of 6 years. This number tells us how sensitive they are to interest rate changes.At the start of the year, an aggregate bond fund was yielding 2.57%. It is now yielding 3.22%. That means it had an interest rate increase of 0.65%. If you multiply that increase by the bond duration, Sabine’s blog you get the change in value of the underlying bonds. In this case, 6 x 0.65% = 3.90%, so the bonds’ market value dropped by 3.90% from January through September 2018.However, the bonds are paying interest. If you average the yield at the start of the year and currently, you get 2.90%. For roughly 9 months in the year, 2.90% x 9 / 12 = 2.13% of earned interest. This nets out to a loss of 1.77% so far this year.

An aggregate bond fund holds thousands of bonds. In their entirety, they have an average weighted life (duration) of 6 years. This number tells us how sensitive they are to interest rate changes.At the start of the year, an aggregate bond fund was yielding 2.57%. It is now yielding 3.22%. That means it had an interest rate increase of 0.65%. If you multiply that increase by the bond duration, Sabine’s blog you get the change in value of the underlying bonds. In this case, 6 x 0.65% = 3.90%, so the bonds’ market value dropped by 3.90% from January through September 2018.However, the bonds are paying interest. If you average the yield at the start of the year and currently, you get 2.90%. For roughly 9 months in the year, 2.90% x 9 / 12 = 2.13% of earned interest. This nets out to a loss of 1.77% so far this year.In summary, we feel bonds add value to most individuals’ portfolios. Over the long run they provide a positive return and have much less volatility than stocks. Additionally, they usually move in the opposite direction of stocks which limits large fluctuations in portfolio value and amplifies the benefit of rebalancing.

If you’re ready to start planning for a brighter financial future, Rockbridge is ready with the advice you need to achieve your goals.