Inflation Commentary (August, 2022)

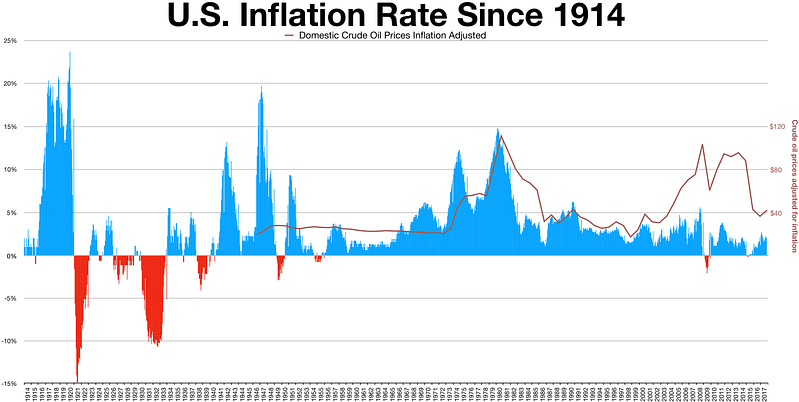

The Consumer Price Index (CPI) climbed to a historically high 9% over the past twelve months prompting concerns for ongoing inflation. There is much discussion in the popular press as to the causes and to the extent it is “transitory” or is becoming embedded in economic activity. While the emergence of inflation contributes to market […]

Capital Market Activity (August, 2022)

After a sharp decline in the first six months of this year, stocks were up nicely in July; a global equity portfolio was up just over 6%. These results were a welcome respite from what we have experienced thus far this year. Markets look to the future. Let us hope they signal positive expectations for […]

How Accurate Are Market Predictions?

If you ask 100 different financial “experts” about future stock market performance, you’ll get 100 different opinions. Most will be wrong, but some, by sheer luck, will be correct (luck is often confused for skill). Investors often rely on expert opinions on what to do with their investments, especially in volatile markets like we are […]

Bear Markets – What do they mean for investors in the long-term?

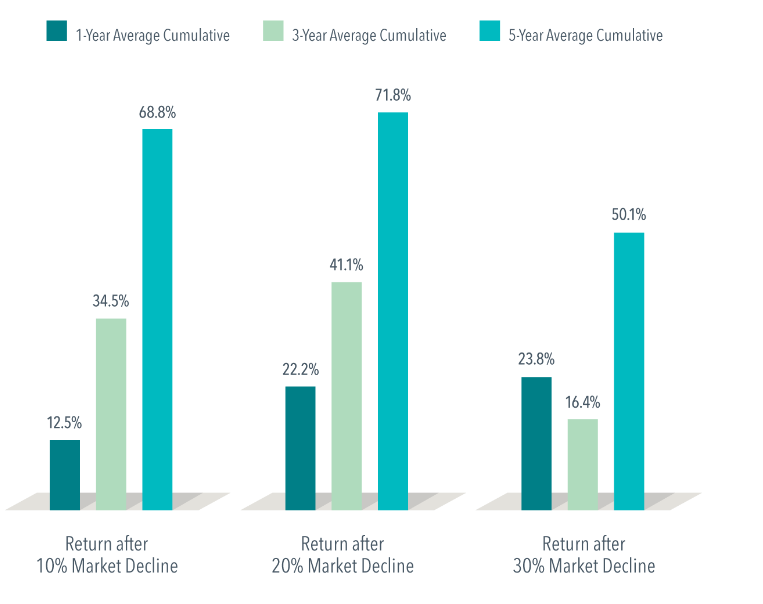

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]

Six Ways a Recession Resembles a Bad Mood

There’s been a lot of talk about recessions lately: Whether one is near, far, or perhaps already here. Whether we can or should try to avoid it. What it even means to be in a recession, and how it’s related to current market turmoil. To put market and recessionary concerns in perspective, it might help […]

Ignore the Headlines

Recent headlines have been dramatic as “Inflation Soars to Highest level in 40 Years!” and “Stocks Plunge to 2022 Lows!” It sounds like the authors are all shouting, and we should really panic. It feels like we should “do something” but let’s take a step back from the headlines, and put today’s market in perspective […]

Capital Market Activity – 05/31/2022

Stock Markets Although rebounding lately, all markets are down year to date. Since December stock markets are off more than 10%. Tech stocks are especially hard hit – an equally weighted portfolio of the largest domestic tech stocks (Apple, Microsoft, Amazon, Google, and Facebook) is off 25%. The premium to value markets, domestic and international, […]

Volatility – Like it or Not – is a Feature of Markets

Stock and bond markets alike are sorting their way through a potent brew of uncertainties these days. War, inflation, supply constraints, rising interest rates, growth concerns, and even crypto-currency dislocations are combining to drive markets lower by the day. It’s certainly no fun to sit through tumultuous markets, but turmoil like we’ve seen recently is […]

How Do We Choose the Funds We Use?

Does it seem like there’s been an extra level of uncertainty lately, threatening your investment plans? Of course, there are always big events going on; that’s the world for you. But today’s brew of geopolitical threats, inflation trends, rising interest rates, recessionary fears, and lingering COVID concerns may feel especially daunting. The market’s volatile reactions […]

Market Commentary: Q1 2022

Stock Markets Not surprisingly, stock markets were volatile this quarter. Faced with a myriad of issues ranging from renewed inflation, historically high equity valuations, winding down the Fed’s “Quantitative Easing”, capped by Russia’s invasion of Ukraine. The largest tech companies held up reasonably well, with Facebook as the only notable exception. Returns from stocks traded […]