Kick-Start Your Child’s Retirement Savings by Rolling Over Unused NYS 529 Plan Assets

With college costs increasing at a rate greater than inflation, investing within a 529 plan offers participants the opportunity to keep up with rising education expenses with some immediate tax savings upon funding. Since there are many unknown factors as to how much your child’s future education expenses will cost, it can be difficult to […]

Making the Case for International Exposure

“Why would I invest in anything other than the S&P 500 if it continues to do so well?” This is a question that is commonly asked by many of our clients over the past few years. To truly optimize your portfolio and ensure you’re not missing out on potential opportunities, it’s crucial to understand the […]

Revisiting I-Bonds

I-Bonds were a fantastic investment opportunity in 2022 as inflation rates were the highest we had seen in decades. I-Bonds purchased from May 1st through October 31st of 2022 earned a return of 9.62% (annualized) for the first six months. Since then, rates on I-Bonds purchased during that period in 2022 have been much more […]

How to Capitalize on High-Interest Rates

Recent periods of high inflation have led to an increase in interest rates to levels not seen in well over a decade. During times like these, it’s important to continue to stay diligent and avoid leaving money on the sidelines earning low returns that are outpaced by inflation and losing purchasing power. With interest rates […]

Staying the Course and Holding Fast to Your Investment Strategy

From social media feeds to financial news outlets, we’re constantly bombarded with a stream of updates, opinions, and analysis. Access to so much information can be empowering, but can also be overwhelming. How do we know which sources to trust and where should we focus our attention? With inflation making daily headlines, stock market volatility, […]

Six Financial Best Practices for Year-End 2022

To say the least, there’s been plenty of political, financial, and economic activity this year—from rising interest rates to elevated inflation, to ongoing market turmoil. How will all the excitement translate into annual performance in our investment portfolios? Markets often deliver their best returns just when we’re most discouraged. So, who knows! While we wait […]

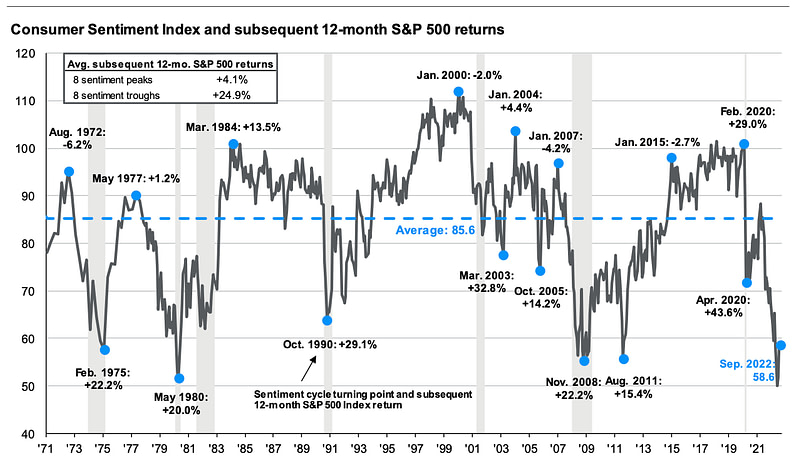

Consumer Sentiment Vs Market Returns

It’s safe to say that both, market prices and investor confidence have taken a hit since the start of the year. Heading into 2022, we had experienced three years of S&P 500 performance averaging over 20% annually- not to mention this was all while dealing with a global pandemic. Since then, the S&P 500 has […]

Inflation Commentary (August, 2022)

The Consumer Price Index (CPI) climbed to a historically high 9% over the past twelve months prompting concerns for ongoing inflation. There is much discussion in the popular press as to the causes and to the extent it is “transitory” or is becoming embedded in economic activity. While the emergence of inflation contributes to market […]

How Accurate Are Market Predictions?

If you ask 100 different financial “experts” about future stock market performance, you’ll get 100 different opinions. Most will be wrong, but some, by sheer luck, will be correct (luck is often confused for skill). Investors often rely on expert opinions on what to do with their investments, especially in volatile markets like we are […]

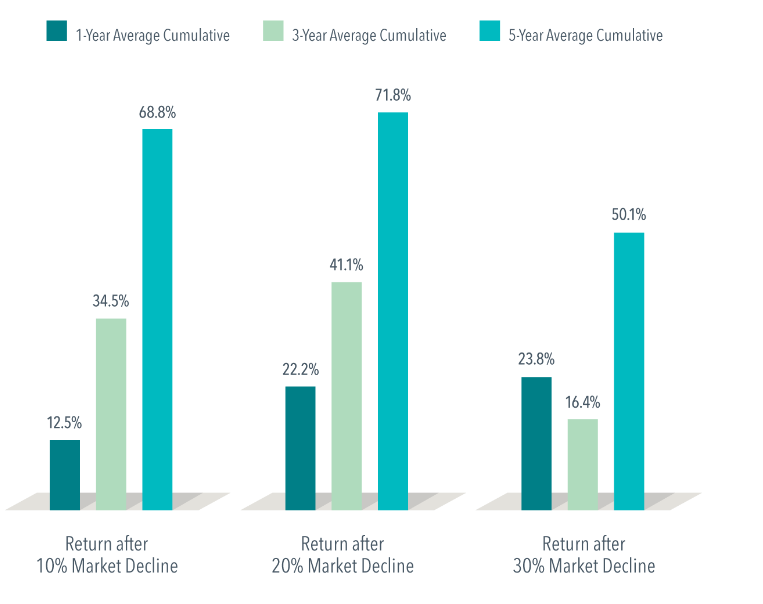

Bear Markets – What do they mean for investors in the long-term?

The most commonly accepted definition of a bear market is a 20% decline in value from the last market high. The S&P 500 has crept into bear market territory on and off so far in 2022, and it’s impossible to know for certain when things are going to turn around. However, when dealing with times […]